Norwegian consulting group Rystad Energy warns that the European Commission’s ambitious plan to speed up the green transition could incur far higher costs than what it has budgeted.

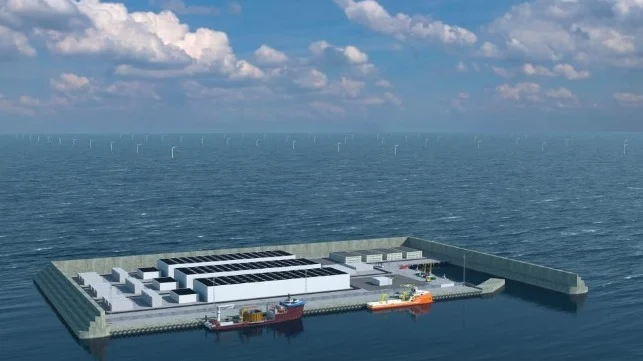

In order to reduce Europe’s dependence on Russian fossil fuels, the EC has proposed increasing renewables’ share of the EU energy marketto 45 percent by 2030, up five percentage points from the previous target. The “REPowerEU” planwould create a major growth opportunity for solar and for offshore wind; in particular, the latter is well-suited for the generation of green hydrogen fuel, a mainstay of the proposal.

In addition to funding support, the plan proposes to ease the permitting rules that are the main impediment to offshore wind development in Europe.At present, it can takeyears to achieve renewables permitting in some EU member states; by way of example, Italy’s first offshore wind farm came online this March, 14 years after it was first proposed and six years after it secured a lease.

To speed up the timeline, the REPowerEU plan would designate renewables as an “overriding public interest” with priority status, and it would encourage member states to set up “go-to” areas designated for rapid development.

However, the price will be steep, and likely far more than what the EC plans to set aside. In addition to a massive rollout of solar PV capacity, Rystad believes the plan will require another 450-490 GW of installed wind capacity by 2030 (onshore and offshore). The investment needed to build out this much wind power comes to about $880 billion, according to Rystad, and the extra solar power would cost another $480 billion.

The total $1.3 trillion price tag far exceeds the $240 billion in loan facilities available now, and the EC’s call for $300 billion in future funding wouldn’t fill the gap. In addition, the project will take more than generating capacity alone. “Regardless of the total amount being assigned to new renewable energy developments, the figures seem to fall considerably below the required additional investment needed in power transmission, storage, gas infrastructure, and hydrogen production,” Rystad assessed.

In addition, introducing a huge surge in demand for renewable-energy infrastructure could result in higher prices for equipment like turbines and solar panels, driving up the capex required for new capacity, Rystad cautioned.

“The ambition of the REPowerEU plan is huge. Power companies and energy markets will be looking for details on investments and infrastructure. While the targets are achievable, it will require wartime-like planning, levels of investment, construction, and production to meet goals by 2030,” said Carlos Torres Diaz, head of power research at Rystad.