South Korea’s crude imports and middle distillate exports will likely extend their upward momentum into June as refiners continue to maximize operating rates to fully capture lucrative product cracks, industry and market participants said over May 20-24.

A recent explosion at the S-Oil Corp. refinery complex in Ulsan will have minimal impact on the country’s overall refining capacity and crude oil demand for May-June as the company has been maintaining normal operations at all of its CDUs, the industry sources said.

South Korea’s crude oil imports in April rose 10.7% year on year to 11.494 million mt, or 84.25 million barrels, marking the seventh consecutive month of year-on-year increase, latest data from the Korea Customs Service showed.

Over January-April, crude imports rose 12% year on year to 343.88 million barrels, the customs data showed.

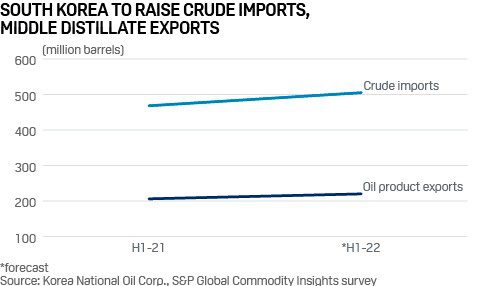

With local refiners aiming to raise their crude throughput to capture robust cracking margins and provide adequate supply of diesel and gasoline to both domestic and Asia-wide consumers, South Korea’s refinery feedstock imports are poised to reach around 505 million barrels in the first half of 2022, up 7.9% from 468.2 million barrels in the same period last year, according to feedstock and plant operation managers based in Seoul, Ulsan, Incheon and Daesan surveyed by S&P Global Commodity Insights.

Local refiners have raised their average crude run rate to nearly 100% — higher than pre-pandemic levels — to take full advantage of lucrative cracks and export margins, a Korea Petroleum Association or KPA official said.

The physical FOB Singapore gasoil crack spread against front month cash Dubai has averaged $/b to date in May, surging from an average of $/b over January-March, S&P Global data showed.

Diesel supply

Middle distillate traders and distributors across Asia initially expressed concern that the current tight supply condition in the region could be further aggravated by the May 19 explosion at S-Oil’s Ulsan refinery complex, as the region’s dependence on South Korean automotive fuel supplies has increased sharply since the outbreak of the Russia-Ukraine conflict.

However, much of the damage at the S-Oil complex was now expected to temporarily hamper petrochemical production rather than middle distillates output, and South Korea’s overall oil product exports are poised to reach around 220 million barrels in H1, compared with 206 million barrels exported a year earlier, according to analysts at KPA and diesel marketers at two major South Korean refiners surveyed by S&P Global.

By raising crude throughput to capture strong margins, South Korean refiners are increasing diesel output for export to maximize profits amid a global supply crunch, the KPA official said.

Local refiners and condensate splitters processed 254.95 million barrels, or 2.83 million b/d, of crude in the first quarter, up 10.8% from 230.03 million barrels a year earlier, rising for the eighth straight month, latest data from state-run Korea National Oil Corp. showed.

The country’s overall stockpile of refined oil products rose 9.8% year on year to 70.62 million barrels as of end-March from 64.33 million barrels a year earlier.

US crude

The customs data showed South Korea’s crude imports from the US in April jumped 18.9% year on year to 10.95 million barrels, marking the 13th consecutive month of year-on-year increase.

Over January-April, US crude imports surged 44.6% year on year to 49.93 million barrels, from 34.54 million barrels in the same period last year.

South Korea is on course to sharply reduce crude imports from Russia as refiners aim to avoid trade, logistics, legal and financial complications and light sweet US crude is considered the country’s best option to fill any Russian supply gaps, crude and condensate trading managers at major South Korean refiners told S&P Global earlier.

Meanwhile, South Korea’s crude imports from its top supplier Saudi Arabia, excluding shipments from the Saudi-Kuwaiti Neutral Zone, climbed 25.7% year on year to 27.26 million barrels in April, the customs data showed.

Final oil data for April will be released later this month by KNOC.