Scorpio Tankers Inc. reported its results for the three months ended March 31, 2022. The Company also announced that its Board of Directors has declared a quarterly cash dividend of $0.10 per share on the Company’s common stock.

Results for the three months ended March 31, 2022 and 2021

For the three months ended March 31, 2022, the Company had a net loss of $84.4 million, or $1.52 basic and diluted loss per share.

For the three months ended March 31, 2022, the Company had an adjusted net loss (see Non-IFRS Measures section below) of $14.9 million, or $0.27 basic and diluted loss per share, which excludes from the net loss (i) a $67.7 million, or $1.22 per basic and diluted share, aggregate write-down of vessels held for sale and loss on the sale of vessels, and (ii) $1.9 million, or $0.03 per basic and diluted share, write-off or acceleration of the amortization of deferred financing fees on the debt or lease financing obligations relating to these vessel sales and related debt extinguishment costs.

For the three months ended March 31, 2021, the Company had a net loss of $62.4 million, or $1.15 basic and diluted loss per share.

For the three months ended March 31, 2021, the Company had an adjusted net loss (see Non-IFRS Measures section below) of $57.3 million, or $1.05 basic and diluted loss per share, which excludes from the net loss $3.9 million, or $0.07 per basic and diluted share, of losses recorded on the transaction to exchange $62.1 million in aggregate principal amount of its existing Convertible Notes due 2022 for $62.1 million in aggregate principal amount of new Convertible Notes due 2025, and $1.3 million, or $0.02 per basic and diluted share, of write-offs of deferred financing fees related to the refinancing of certain credit facilities.

Declaration of Dividend

On April 27, 2022, the Company’s Board of Directors declared a quarterly cash dividend of $0.10 per common share, payable on or about June 15, 2022 to all shareholders of record as of May 20, 2022 (the record date). As of April 27, 2022, there were 59,401,013 common shares of the Company outstanding.

Summary of First Quarter 2022 and Other Recent Significant Events

• During the first quarter of 2022, the Company entered into agreements to sell 17 vessels, consisting of two LR2s, 12 LR1s, and three MRs. Seven of these sales closed within the first quarter of 2022 (six LR1s and one MR), raising $91.6 million in aggregate new liquidity after the repayment of debt and selling costs, three of these sales have closed within April 2022 (two LR1s and one MR), raising $39.8 million in aggregate new liquidity after the repayment of debt and selling costs, and the remaining seven vessels are expected to close before the end of the third quarter 2022. These remaining vessels are expected to raise $112.7 million in aggregate new liquidity after the repayment of debt and estimated selling costs.

• In April 2022, the Company entered into an agreement to sell an LR2 tanker, STI Nautilus, for $42.7 million. This sale is expected to raise approximately $22.0 million in aggregate new liquidity after the repayment of debt and estimated selling costs, and it is expected to close before the end of the third quarter of 2022.

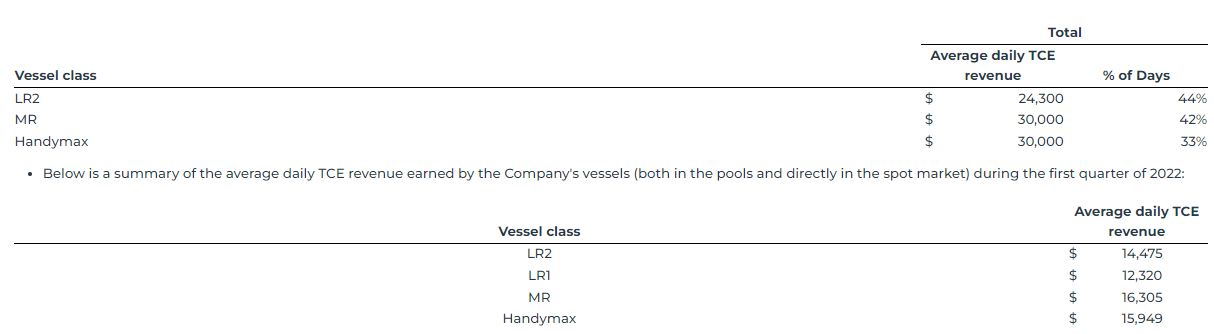

• Below is a summary of the average daily Time Charter Equivalent (“TCE”) revenue (see Non-IFRS Measures section below) and duration of contracted voyages and time charters for the Company’s vessels (both in the pools and directly in the spot market) thus far in the second quarter of 2022 as of the date hereof (See footnotes to “Other operating data” table below for the definition of daily TCE revenue):

• Below is a summary of the average daily TCE revenue earned by the Company’s vessels (both in the pools and directly in the spot market) during the first quarter of 2022:

• The Company has $38.3 million of additional liquidity available from previously announced financings or refinancings that have been committed. These drawdowns are expected to occur at varying points in the future as certain of these financings are tied to scrubber installations on the Company’s vessels.

Sales of Vessels

During the first quarter of 2022, the Company entered into agreements to sell 17 vessels, consisting of two LR2s, 12 LR1s, and three MRs. The sales prices of the two LR2s (STI Savile Row and STI Carnaby) are $43.0 million per vessel, the 12 LR1s (STI Excelsior, STI Executive, STI Excellence, STI Pride, STI Providence, STI Prestige, STI Experience, STI Express, STI Exceed, STI Excel, STI Expedite, and STI Precision) are $413.8 million in aggregate, and each of the three MRs (STI Fontvieille, STI Benicia, and STI Majestic) are $23.5 million, $26.5 million, and $34.9 million, respectively.

Seven of these sales closed within the first quarter of 2022 (six LR1s and one MR), raising $91.6 million in aggregate new liquidity after the repayment of debt and selling costs, three of these sales have closed within April 2022 (two LR1s and one MR), raising $39.8 million in aggregate new liquidity after the repayment of debt and selling costs, and the remaining seven vessels are expected to close before the end of the third quarter 2022. These remaining vessels are expected to raise approximately $112.7 million in aggregate new liquidity after the repayment of debt and selling costs.

During the first quarter, the Company recorded an aggregate loss on the sale of vessels or write-down of vessels held for sale of $67.7 million for the 17 vessels that were agreed to be sold. Additionally, the Company wrote-off, or accelerated the amortization of deferred financing fees of $1.9 million with respect to the debt or lease financings relating to these vessels during the first quarter of 2022.

Additionally, in April 2022, the Company entered into an agreement to sell an LR2 tanker, STI Nautilus, for $42.7 million. This sale is expected to raise approximately $22.0 million in aggregate new liquidity, after the repayment of debt and estimated selling costs. This sale is expected to result in a gain of approximately $2.5 million in the second quarter of 2022, and it is expected to close before the end of the third quarter of 2022.

Diluted Weighted Number of Shares

The computation of earnings or loss per share is determined by taking into consideration the potentially dilutive shares arising from (i) the Company’s equity incentive plan, and (ii) the Company’s Convertible Notes due 2022 and Convertible Notes due 2025. These potentially dilutive shares are excluded from the computation of earnings or loss per share to the extent they are anti-dilutive.

The impact of the Convertible Notes due 2022 and Convertible Notes due 2025 on earnings or loss per share is computed using the if-converted method. Under this method, the Company first includes the potentially dilutive impact of restricted shares issued under the Company’s equity incentive plan, and then assumes that its Convertible Notes due 2022 and Convertible Notes due 2025, which were issued in March and June 2021 were converted into common shares at the beginning of each period. The if-converted method also assumes that the interest and non-cash amortization expense associated with these notes of $6.4 million during the three months ended March 31, 2022 were not incurred. Conversion is not assumed if the results of this calculation are anti-dilutive.

For the three months ended March 31, 2022, the Company’s basic weighted average number of shares outstanding were 55,409,131. There were 57,130,119 weighted average shares outstanding including the potentially dilutive impact of restricted shares issued under the Company’s equity incentive plan for the three months ended March 31, 2022. There were 64,467,902 weighted average shares outstanding for the three months ended March 31, 2022 under the if-converted method. Since the Company was in a net loss position in both periods, the potentially dilutive shares arising from both restricted shares issued under the Company’s equity incentive plan and under the if-converted method were anti-dilutive for purposes of calculating the loss per share. Accordingly, basic weighted average shares outstanding were used to calculate both basic and diluted loss per share for this period.

Current Liquidity

As of April 27, 2022, the Company had $280.5 million in unrestricted cash and cash equivalents. In the next few days, the Company is expected to receive $33.8 million from the sale of one LR1 tanker (after estimated selling costs). The debt for this vessel was repaid prior to April 27, 2022. Our pro-forma cash balance, including the net proceeds from the sale of this vessel, was $314.3 million as of April 27, 2022.

Drydock, Scrubber and Ballast Water Treatment Update

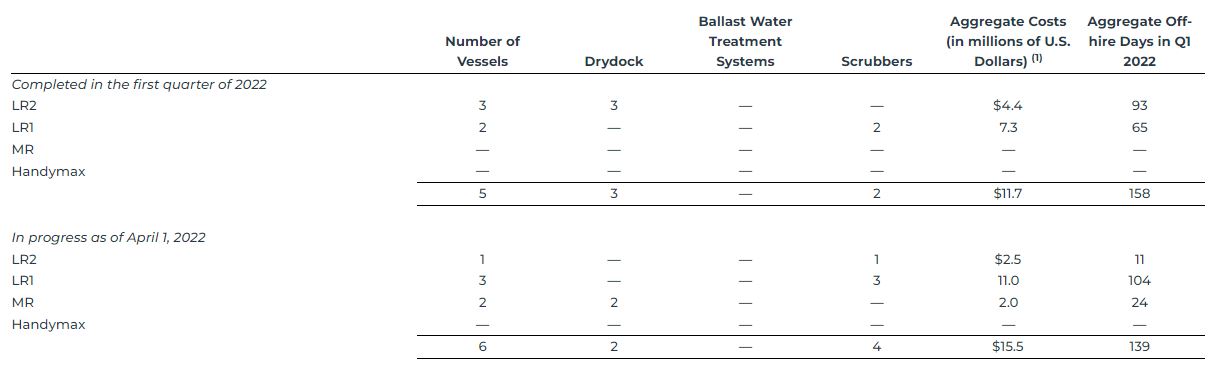

Set forth below is a table summarizing the drydock, scrubber, and ballast water treatment system activity that occurred during the first quarter of 2022 and that is in progress as of April 1, 2022.

Set forth below are the estimated expected payments to be made for the Company’s drydocks, ballast water treatment system installations, and scrubber installations through 2023 (which also include actual payments made during the second quarter of 2022 and through April 27, 2022):

Set forth below are the estimated expected number of vessels and estimated expected off-hire days for the Company’s drydocks, ballast water treatment system installations, and scrubber installations

Debt

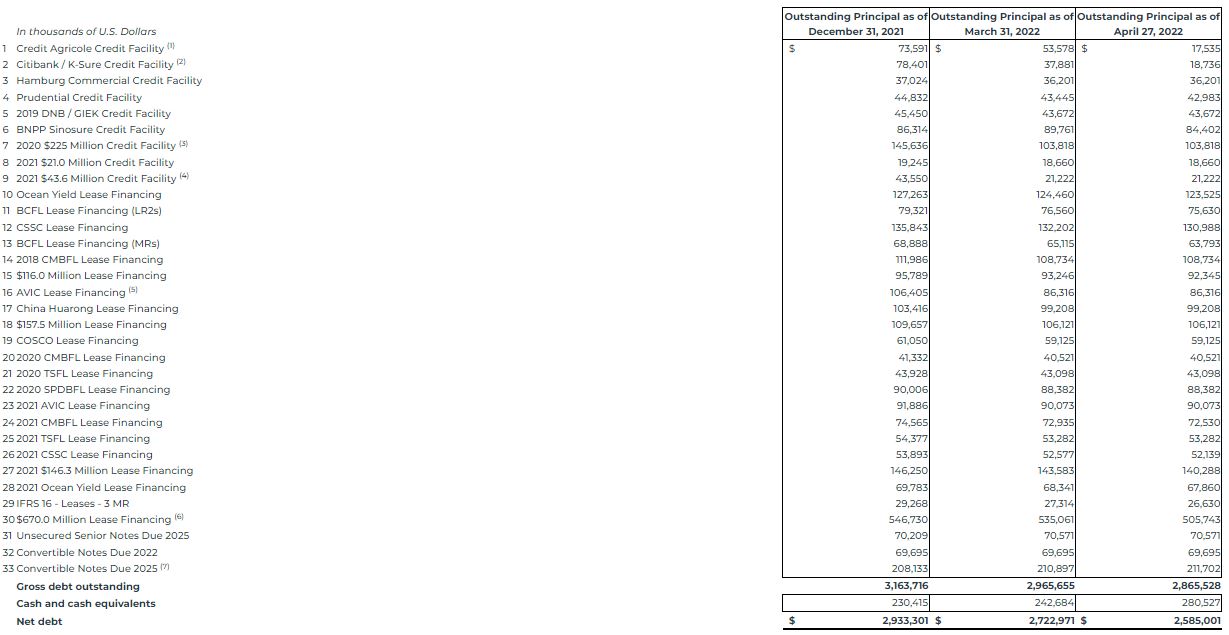

Set forth below is a summary of the principal balances of the Company’s outstanding indebtedness as of the dates presented.

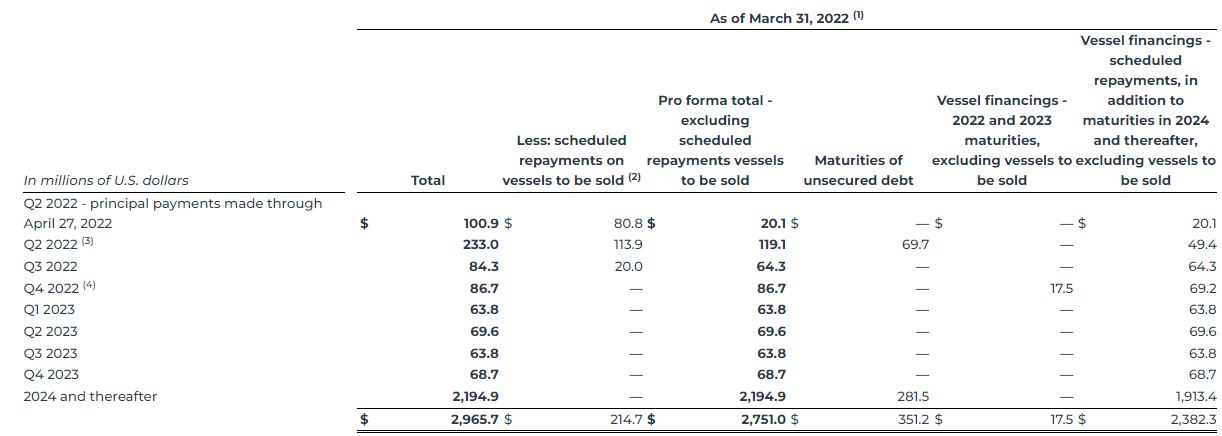

Set forth below are the estimated expected future principal repayments on the Company’s outstanding indebtedness as of March 31, 2022, which includes principal amounts due under the Company’s secured credit facilities, Convertible Notes due 2022, Convertible Notes due 2025, lease financing arrangements, Senior Notes due 2025, and lease liabilities under IFRS 16 (which also include actual scheduled payments made during the second quarter of 2022 through April 27, 2022):

Explanation of Variances on the First Quarter of 2022 Financial Results Compared to the First Quarter of 2021

For the three months ended March 31, 2022, the Company recorded a net loss of $84.4 million compared to a net loss of $62.4 million for the three months ended March 31, 2021. The following were the significant changes between the two periods:

• TCE revenue, a Non-IFRS measure, is vessel revenues less voyage expenses (including bunkers and port charges). TCE revenue is included herein because it is a standard shipping industry performance measure used primarily to compare period-to-period changes in a shipping company’s performance irrespective of changes in the mix of charter types (i.e., spot voyages, time charters, and pool charters), and it provides useful information to investors and management. The following table sets forth TCE revenue for the three months ended March 31, 2022 and 2021:

• TCE revenue for the three months ended March 31, 2022 increased by $39.2 million to $172.0 million, from $132.8 million for the three months ended March 31, 2021. Overall average TCE revenue per day increased to $15,415 per day during the three months ended March 31, 2022, from $11,166 per day during the three months ended March 31, 2021.

TCE revenue for the three months ended March 31, 2022 reflected an improving spot market for product tankers, particularly at the end of quarter, which was triggered by myriad factors including (i) the easing of COVID-19 restrictions around the globe which triggered increased personal mobility and the demand for refined petroleum products; (ii) strengthening refining margins which, combined with low global refined petroleum product inventories, increased demand for the seaborne transportation of refined petroleum products, and; (iii) the volatility brought on by the conflict in Ukraine, which has disrupted supply chains for crude oil and refined petroleum products, changing volumes and trade routes, and thus increased ton-mile demand for refined petroleum products.

• TCE revenue for the three months ended March 31, 2021 reflected the adverse market conditions brought on by the COVID-19 pandemic. Demand for crude and refined petroleum products remained low during this period as inventories that built up during 2020 continued to be drawn, and most countries throughout the world continued to implement restrictive policies in an effort to control the spread of the virus.

• Vessel operating costs for the three months ended March 31, 2022 increased by $1.5 million to $84.8 million, from $83.3 million for the three months ended March 31, 2021. Vessel operating costs per day increased to $7,290 per day for the three months ended March 31, 2022 from $6,891 per day for the three months ended March 31, 2021. Vessel operating costs per day increased across most vessel classes, driven by increased repairs and maintenance, and spares and stores expenses.

• Depreciation expense – owned or sale leaseback vessels for the three months ended March 31, 2022 decreased by $4.7 million to $44.1 million, from $48.8 million for the three months ended March 31, 2021. This decrease is attributable to 17 of the Company’s vessels being designated as held for sale during the three months ended March 31, 2022. These vessels were written down to their net realizable value upon being designated as held for sale, and depreciation expense ceased being recorded upon that designation. Therefore, depreciation expense for these vessels only reflected a partial period during the three months ended March 31, 2022, and the Company expects depreciation expense to decrease slightly in subsequent quarters to reflect the full impact of these vessel sales.

• Depreciation expense – right of use assets for the three months ended March 31, 2022 decreased by $2.1 million to $9.7 million from $11.8 million for the three months ended March 31, 2021. Depreciation expense – right of use assets reflects the straight-line depreciation expense recorded under IFRS 16 – Leases. Right of use asset depreciation expense was impacted by the expiration of the bareboat charter-in agreements on four Handymax vessels at the end of the first quarter of 2021. The Company had four LR2s and 18 MRs that were accounted for under IFRS 16 – Leases during the three months ended March 31, 2022.

• General and administrative expenses for the three months ended March 31, 2022, decreased by $1.1 million to $12.5 million, from $13.6 million for the three months ended March 31, 2021. This decrease was primarily due to a reduction in restricted stock amortization.

• Financial expenses for the three months ended March 31, 2022 increased by $3.9 million to $38.0 million, from $34.1 million for the three months ended March 31, 2021. This increase was primarily attributable to the increase in the accretion of convertible notes, which increased to $4.1 million from $1.9 million for the three months ended March 31, 2022 and 2021, respectively. This increase was due to the issuance of the Convertible Notes due 2025 in March and June 2021.

Dividend Policy

The declaration and payment of dividends is subject at all times to the discretion of the Company’s Board of Directors. The timing and the amount of dividends, if any, depends on the Company’s earnings, financial condition, cash requirements and availability, fleet renewal and expansion, restrictions in loan agreements, the provisions of Marshall Islands law affecting the payment of dividends and other factors.

The Company’s dividends paid during 2021 and 2022 were as follows:

On April 27, 2022, the Company’s Board of Directors declared a quarterly cash dividend of $0.10 per common share, payable on or about June 15, 2022 to all shareholders of record as of May 20, 2022 (the record date). As of April 27, 2022, there were 59,401,013 common shares of the Company outstanding.

$250 Million Securities Repurchase Program

In September 2020, the Company’s Board of Directors authorized a new Securities Repurchase Program to purchase up to an aggregate of $250 million of the Company’s securities which, in addition to its common shares, currently consist of its Senior Notes due 2025 (NYSE: SBBA), which were originally issued in May 2020, Convertible Notes due 2022, which were issued in May and July 2018, and Convertible Notes due 2025, which were issued in March and June 2021. No securities have been repurchased under the new program since its inception through the date of this press release.

COVID-19

Since the beginning of calendar year 2020, the outbreak of the COVID-19 virus has resulted in a significant reduction in global economic activity and extreme volatility in the global financial markets, the effects of which continued throughout 2021. While the easing of restrictive measures that were put in place to combat the spread of the virus, and the successful roll-out of vaccines in certain countries served as a catalyst for an economic recovery in many countries throughout the world, the Company expects that the COVID-19 virus will continue to cause volatility in the commodities markets. In particular, the spread of more contagious and vaccine resistant variants, along with the continued implementation of restrictive measures by governments in certain parts of the world, have hampered a full re-opening of the global economy, thus preventing demand for refined petroleum products from reaching pre-pandemic levels. The scale and duration of these circumstances is unknowable but could continue to have a material impact on the Company’s earnings, cash flow and financial condition. An estimate of the impact on the Company’s results of operations, financial condition, and future performance cannot be made at this time.

Conflict in Ukraine

The recent military conflict in Ukraine has had a significant direct and indirect impact on the trade of refined petroleum products. This conflict has resulted in the United States, United Kingdom, and the European Union, among other countries, implementing sanctions and executive orders against citizens, entities, and activities connected to Russia. Some of these sanctions and executive orders target the Russian oil sector, including a prohibition on the import of oil from Russia to the United States or the United Kingdom. The Company cannot foresee what other sanctions or executive orders may arise that affect the trade of petroleum products. Furthermore, the conflict and ensuing international response has disrupted the supply of Russian oil to the global market, and as a result, the price of oil and petroleum products has experienced significant volatility. The Company cannot predict what effect the higher price of oil and petroleum products will have on demand, and it is possible that the current conflict in Ukraine could adversely affect the Company’s financial condition, results of operations, and future performance.