Shippers are having to wait out what could be a sea change in trade flows due to tariffs and expected inflationary pressures, the CEO of ship management company V. Group said in an interview.

While there will be increasing pressure to home-shore industries, this process could take time and, amid inflationary pressure, goods will find new markets and new trade patterns will emerge, Rene Kofod-Olsen, CEO of V. Group, told Platts, part of S&P Global Commodity Insights.

“From a shipping perspective, you can’t really do anything because cargoes have to be moved anyway,” Kofod-Olsen said. “In the end, it’s the consumer who’s going to pay the price, so there’s an inflationary aspect.”

The company manages over 3,000 vessels, according to its website.

The impact of a tariff conflict between the US administration of President Donald Trump and its trade partners may distort supply chains and affect a potential decline in overall demand due to worsening economics, according to shipping and energy market professionals. So too might the evolving narrative around US port fees on Chinese-made ships.

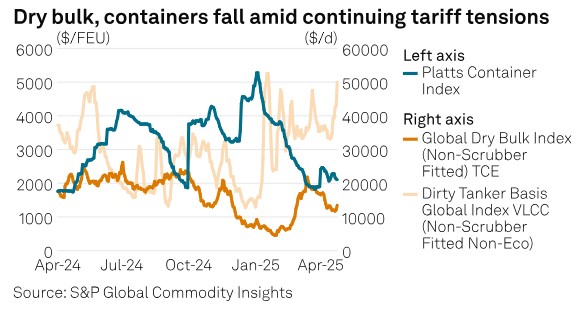

Before inflation starts eroding general demand, container shipping and dry bulk are the two sectors at greatest risk from changing tariffs, due to considerable trade in packaged consumer goods and agricultural produce between the US and China, according to analysts.

These two sectors have seen prices fall since Trump announced his “Liberation Day” tariff regime at the start of April. The Platts Container Index ended April 23 at $2,/forty foot-equivalent unit, down 13% from the start of the month, and the Platts Global Dry Bulk Index fell 19% from the start of the month to $13,/day Time Charter Equivalent for a non-scrubber-fitted vessel.

By contrast, the Platts VLCC Index has risen 36% from the start of the month to $49,/day TCE on April 23 for a non-scrubber-fitted and non-eco vessel.

Russia sanctions hardest to keep up with

There are international sanctions on the carriage of oil from Russia, Iran and Venezuela and these all present headaches for the tanker markets. In efforts to avoid falling foul of sanctions regimes, companies must avoid business with a growing so-called shadow fleet of vessels.

V. Group has been fully compliant with sanctions since they came into force and it requires a “whole army” of staff to be so Whenever the company works with a ship this means looking at the counterparty and all trade patterns it has been involved in, Kofod-Olsen said.

“It is very clear that the world will not accept the dark fleet as part of world trade, mostly from a liability perspective,” Kofod-Olsen said. “It is a risk conversation, where obviously [vessels] are not maintained to the same standard… It’s a risk and the politicians need to step up to this,” he said.

Russia presents the biggest sanctions challenge because of the huge section of the market that Russia represents: “That is very complex because you have all that trade and do remember that Russia is still exporting,” Kofod-Olsen said.

Russia’s seaborne crude exports, excluding barrels offered by Kazakh suppliers, averaged 3.449 million b/d through April 22, on par with March’s 3.571 million b/d, according to data from S&P Global Commodities at Sea. As in March, India and China lifted 78% of the month-to-date volume, the data showed.

Sanctioned vessels have facilitated 15% of this month’s export volume, a three-point increase from the proportions observed in February and March, CAS data showed.

Waiting for Red Sea developments

As a ship manager rather than a charterer or owner, V. Group cannot refuse to transit the Red Sea, to avoid Houthi attacks. However, as V. Group “just stopped transiting” when trouble started at the end of 2023, it was clear that the wider industry saw the threat as serious.

When they started, these attacks were linked to the Israel-Hamas war and while a peace settlement there has proved elusive there have been no confirmed attacks on merchant shipping in the region since November.

Since the start of the Gaza conflict Suez Canal traffic has comprised vessels linked to China or those transporting Iranian and Russian oil, and most mainstream and compliant fleets continue to avoid the Red Sea as security concerns persist.

Even so, tanker transits through the Suez Canal saw a strong rebound in March, rising 40% from February to 411 vessels. Larger tanker classes contributed significantly to the increase, with the share of laden ships also climbing to 44%, according to CAS data.

This comes either despite or because Trump increased air strikes in Yemen against the Houthi movement in March and warned them to stop the attacks in the Red Sea. Egyptian PM Mustafa Madbouly noted in April that navigation security had improved in the area.

V. Group has had around eight vessels transit the Red Sea since January, Kofod-Olsen said.

A clearer vote of confidence in the region’s security will be if containers resume transit in meaningful numbers, Kofod-OIsen said.

Source: Platts