ADNOC L&S announces acquisition of fellow UAE Zakher Marine International, making it a major OSV and liftboat player in the region

As offshore oil and gas development further strengthens in the Middle East, consolidation in the region continues to gain momentum, with the latest M&A agreement struck between two of the UAE’s largest OSV and liftboat players.

In a move that will boost its presence in the Middle East OSV and liftboat market, ADNOC Logistics & Services (ADNOC L&S) said it was acquiring Zakher Marine International (ZMI). Details of the transaction were not disclosed.

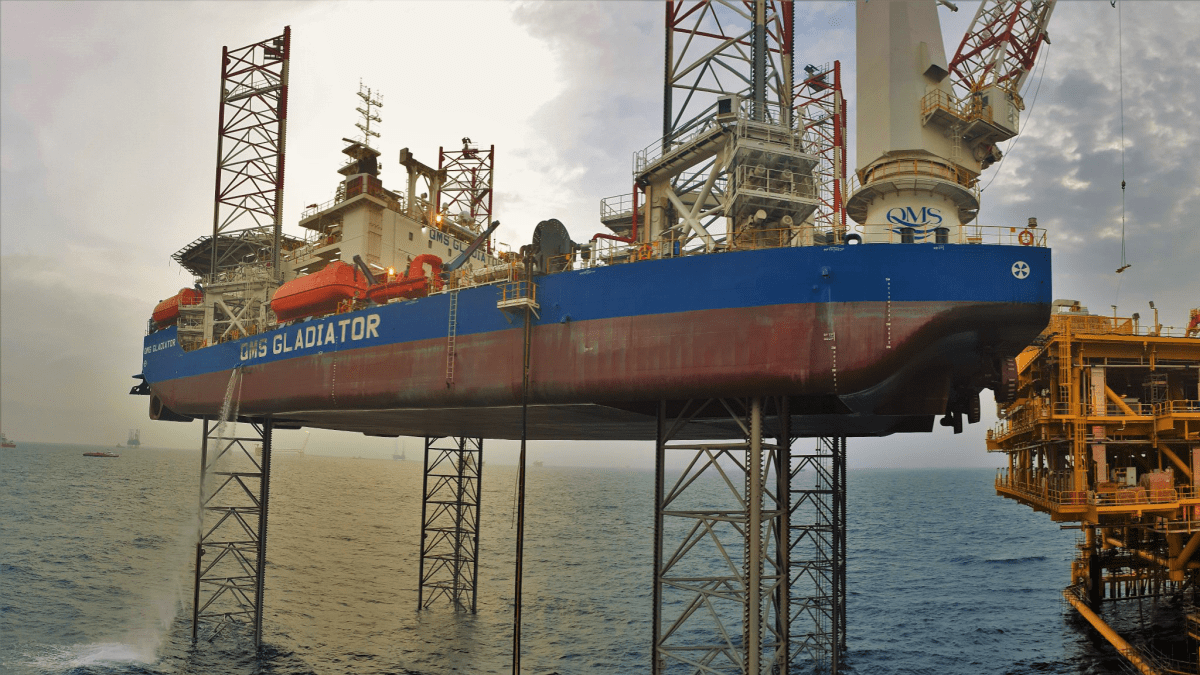

Abu Dhabi-based ZMI owns and operates a fleet of OSVs and one of the world’s largest and most valuable fleets of self-propelled jack-up barges.

ADNOC L&S said once the transaction closes, it would add 24 jack-up barges and 38 OSVs to its fleet.

ZMI is expected to continue operating as a standalone entity under ADNOC L&S, led by Ali Hassan El Ali as CEO.

The transaction is the second major consolidation announced in the OSV market in the last five months, following in the wake of Tidewater’s US$190M acquisition of Swire Pacific Offshore. That deal, too, expanded Tidewater’s footprint in the Middle East.

In a recent analysis, Westwood Global Energy said the tightening global OSV market is driving improvements in utilisation, led by the Middle East, which is near 90% effective utilisation, likely resulting in a “sold out” market by the end of the year.“There has been a significant uptick in rates for new tenders in the region, which in turn is encouraging mass reactivations as well as opportunistic sale and purchase (S&P) activity,” said the analysts.

“There has been a significant uptick in rates for new tenders in the region”

A major player in the Middle East, Singapore-based Miclyn Express Offshore (MEO) announced a nine-year charter for its crewboats Express 88 and Express 91 “working for a national oil major in the Middle East” starting June 2022.

MEO is also bolstering its fleet with newbuilds. It ordered five 42 m crewboats from Penguin Shipyard International. Based on Penguin’s Flex-42X and Flex-40X designs, the five new crewboats are set for delivery between 2023 and 2024 as part of a MEO Group’s fleet rejuvenation programme.

MEO has a fleet of 65 vessels, many deployed in the Middle East.

Other shoe drops

On 27 July, the day after announcing its acquisition of ZMI, ADNOC L&S’s parent, Abu Dhabi National Oil Co (ADNOC), dropped the ‘other shoe’; it announced the award of a contract to ADNOC L&S valued at US$681M for the provision of offshore logistics and marine support services. The ADNOC L&S contract came in the wake of two other substantial contracts, totaling US$2Bn, to ADNOC Drilling for the Hail and Ghasha Development Project. The contracts comprise US$1.3Bn for integrated drilling services and fluids, and US$711M for the provision of four Island Drilling Units.

“Abu Dhabi’s vast gas resources can play an increasingly important role in providing lower-carbon energy”

Overall, more than 80% of the value of the awards will flow back into the UAE’s economy under ADNOC’s successful In-Country Value (ICV) programme and all three of the contracts will cover the Hail and Ghasha drilling campaign for a maximum of 10 years.

The Hail and Ghasha Development Project is part of the Ghasha Concession, which is the world’s largest offshore sour gas development and a key component of ADNOC’s integrated gas masterplan, as well as an important enabler of gas self-sufficiency for the UAE.

Dr Sultan Ahmed Al Jaber, minister of industry and advanced technology and managing director and group CEO of ADNOC said: “These substantial awards mark another important milestone in the delivery of the Ghasha mega-project. They also demonstrate the deep expertise and experience within ADNOC Drilling and the wider group to efficiently deliver complex projects that enable gas expansion, while generating substantial in-country value to drive economic growth and diversification.

“ADNOC is committed to unlocking the UAE’s abundant natural gas reserves to enable domestic gas self-sufficiency, industrial growth and diversification, as well as to meet growing global gas demand, in line with the UAE Leadership’s wise directives. Abu Dhabi’s vast gas resources can play an increasingly important role in providing lower-carbon energy to meet the demands of today and tomorrow, while the world still relies on hydrocarbons,” said ADNOC.

ADNOC’s gas masterplan links every part of the gas value chain to ensure a sustainable and economic supply of natural gas to meet the growing requirements of the UAE and international markets, through expansion of ADNOC’s LNG capacity.

Production from the Ghasha Concession is expected to start in 2025, ramping up to produce more than 1.5 billion standard cubic feet per day (scfd) of natural gas before the end of the decade. Four artificial islands have already been completed and development drilling is underway.

In November last year, ADNOC and its partners awarded two engineering, procurement and construction (EPC) contracts for the Dalma Gas Development Project, within the Ghasha Concession. They also awarded a contract to update the front-end engineering and design (FEED) for the Hail and Ghasha project. The updated design is expected to be completed by the end of the year and will further optimise costs and timing, as well as potentially accelerate the integration of carbon capture.

Rig and OSV demand

“The industry has gone through six years of car crash; now we are in a much better place and the market is improving strongly,” ABC Maritime head of offshore George Horsington told delegates at the Annual Offshore Support Journal Conference in London in June. “The most important thing about the Middle East is Saudi Aramco. It produces 11M barrels of oil per day. Saudi Aramco is on a drive to hire rigs. A drive to hire boats.”

Mr Horsington explained that Saudi Aramco’s strategy has been mid-size anchor handlers, typically 6,000 to 8,000 horsepower, DP2s, and smaller PSVs, less than 3,000 tonnes deadweight. “But this year there was a major move forward when Aramco chartered its first high deadweight PSV,” he said, adding “I believe it came from Seacor. They fixed one of their battery-hybrid vessels into Aramco.” He noted whatever approach Aramco decides to take will drive vessel demand in the Middle East.