With shipping widely acknowledging that the tanker sector is finally in the ascendant after a dire 18 months, prices for newbuilds and secondhand tonnage are now “on a tear”, according to a new report from Poten & Partners.

VLCC newbuilding prices have increased from $88.4m in January 2021, to $119m, an increase of 35%, according to the New York-based tanker broker. Secondhand prices have shown a similar trend. Over the same time period, prices for five-year-old VLCCs are up 23% and 10-year old VLCCs 31%. The price developments in the other tanker segments, from suezmaxes down to MRs mostly mirror those of the VLCCs. The last time asset prices increased like that was during the tanker supercycle from 2004 to 2008.

So far, newbuilding prices have increased faster than secondhand values in the current cycle. However, Poten argued in its most recent weekly report that this will likely change if rates continue to recover.

Also looking at rising asset prices has been London-based brokers Gibson who pointed out that five-year-old MR tankers have appreciated in value in 2022 from $29m to $34m, a price that exceeds the price of a newbuild MR back in January 2021.

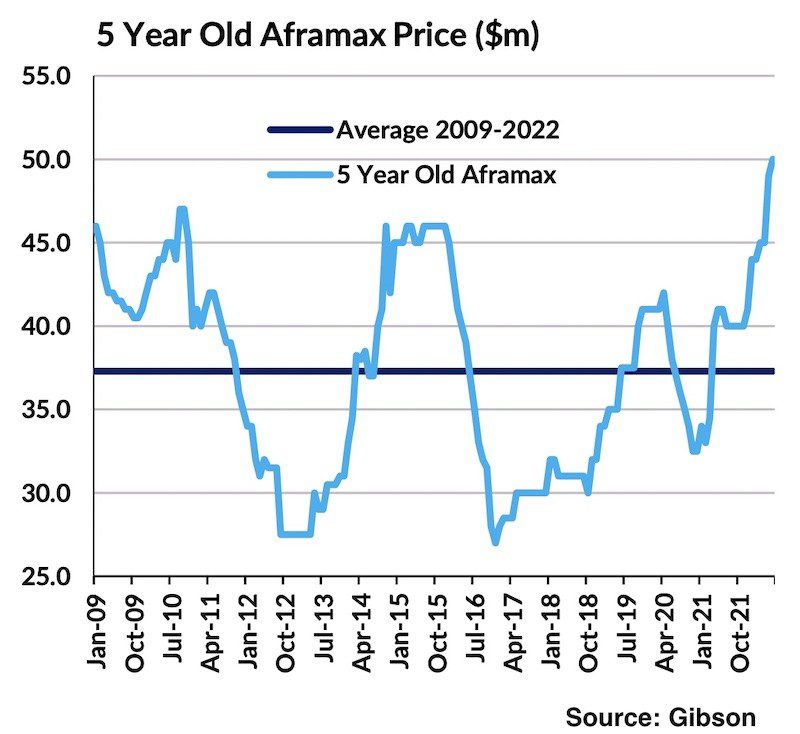

Aframaxes have shown even more impressive price rises, with five-year-old values rising 50% since January 2021 to $51m to exceed newbuilding prices seen in early 2021.

Gibson reckons prices could still be driven higher, stating in its latest market report: “Ultimately, there is still the potential for further upside in tanker asset values; however, increasingly the downside risk is coming into focus. Owners can take comfort from a low orderbook and be encouraged by the reallocation of trade prompted by Russia’s invasion of Ukraine, yet how they balance this against the broader macroeconomic picture will ultimately depend on their appetite for risk.”

By and large, analysts are very gung-ho about tanker prospects, led by VLCCs. In a report entitled ‘Medium-term tanker fleet fundamentals to support a golden age’, BRS looked at the low tanker orderbook, something it said was down to a combination of a tanker market in the doldrums, technological uncertainty and high shipbuilding prices. Today’s 34,000 dwt and above tanker orderbook stands at 293 units totalling 34.2m dwt, the lowest recorded since 1999.