Historical and projected data highlighting the shift towards a new lease of life for older ships are clear, starkly represented by the growing number of VLCCs aged over 20 years now remaining in the commercial space combined with the well-documented record-low single vessel delivery in 2024, with just five new builds expected this year.

Indicative of a move away from the more stable patterns of the past into a more uncertain climate, the increase of older, and therefore less efficient, ships in the fleet is a significant issue arising during a time of various market challenges, requiring specific consideration by VLCC owners and operators when making strategic, profitable decisions.

Exploring the causes and impact of the abnormal fleet profile, which continues to diverge from the traditional situation in terms of fewer vessels exiting, is intrinsic to interpreting the current landscape. Beyond monitoring just the nominal increase in fleet capacity, a deeper analysis around the ageing population and the correlated themes of changing trading patterns and declining operational efficiency provides a more nuanced understanding of the true state of the VLCC market.

Our insight reveals that, over the past five years, the true operational growth in terms of usable capacity of just 60 VLCC equivalent is significantly lower than the nominal growth of 100 units added to the global fleet. Looking ahead, there is a projected effective supply growth of only 1% in the next three years, compared to an 8% nominal capacity increase.

This paradoxical situation, where the fleet is growing in number, but the effective supply remains stagnant or in decline, indicates that the VLCC market faces a prolonged period of supply tightness. This is further supported when scrutinising other factors such as a slow newbuilds delivery profile with a low orderbook and longer lead times, and the rise of the dark fleet trading in sanctioned business.

Leveraging data from our pool’s proprietary fixture statistics is critical to gain complete insight into the ramifications of the ageing fleet within the wider market dynamics, enabling operators, owners and charterers to maximise adaptability and agility when overcoming challenges and responding to the latest developments.

Delayed retirement

Over the past five years, there has been a fundamental change in the typical cut-off point at which VLCCs stop sailing to be scrapped or sold on for FPSO. Whereas 18-20 years old was traditionally considered an optimal retirement age from active trading within the fleet across the tanker segment, it is now the case that VLCCs aged up to 25 years are remaining in commercial operation, rather than be scrapped.

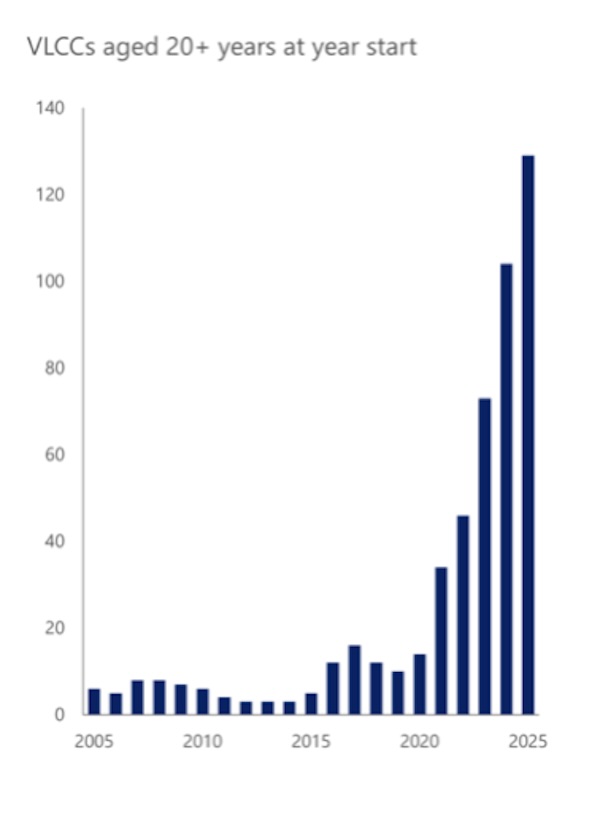

Around 130 VLCCs aged more than 20 years remain in employment in 2025 compared to less than 20 just five years ago.

Over the next four years, the number of vessels exceeding 20 years will double, representing 21% of the trading fleet.

Historically low orderbook

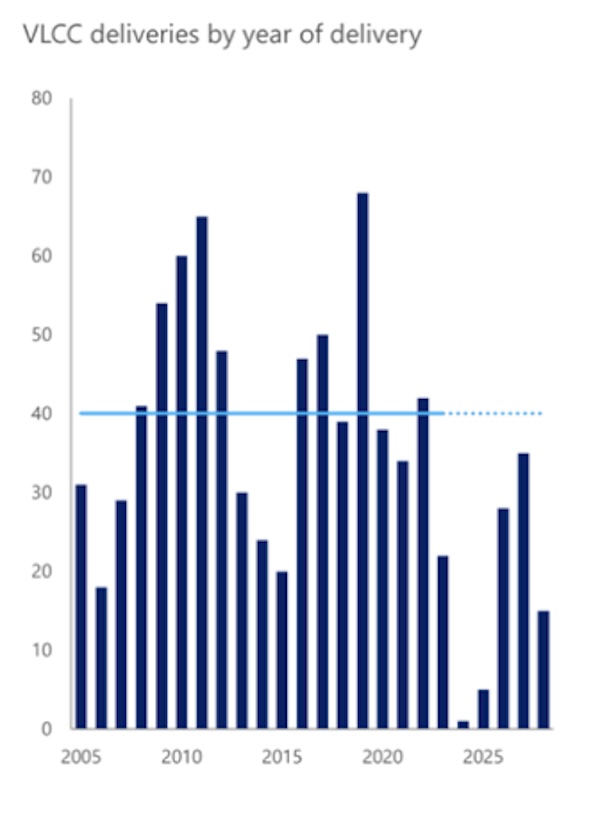

Exacerbating the abnormal fleet profile and high average vessel age, only one new VLCC was delivered last year with just five expected in 2025, compared to an historical average of 40 deliveries per year.

Owner uncertainty in the tanker sector about which direction to take in terms of new vessel orders, future and alternative fuel technologies and long-term fuel strategies in the light of future ship design and meeting new and upcoming environmental regulations is particularly reflected in the current small orderbook for VLCCs.

Although the number of deliveries for 2026 is set to rise to 28 deliveries, with a continuing trend of growth in the following year, the fact remains that there is a deficit of VLCCs on order to replace the current older fleet, if they were all retired today based on historical standards. The total orderbook of VLCCs of approximately 82 ships compares to more than 100 VLCCs aged more than 20 years.

Longer lead times of two to three years and reduced shipyard capacity in the VLCC sector is also contributing to the lag in deliveries.

The dark fleet

A key disrupter to the traditional cycle, where ageing ships were phased out of the fleet and the global VLCC supply market was consistently balanced and refreshed, is the rise of the dark fleet. With geopolitical events and tightening sanctions continuing to reshape the market and some oil-producing nations facing export restrictions, one telling outcome is the creation of new trading opportunities for older ships.

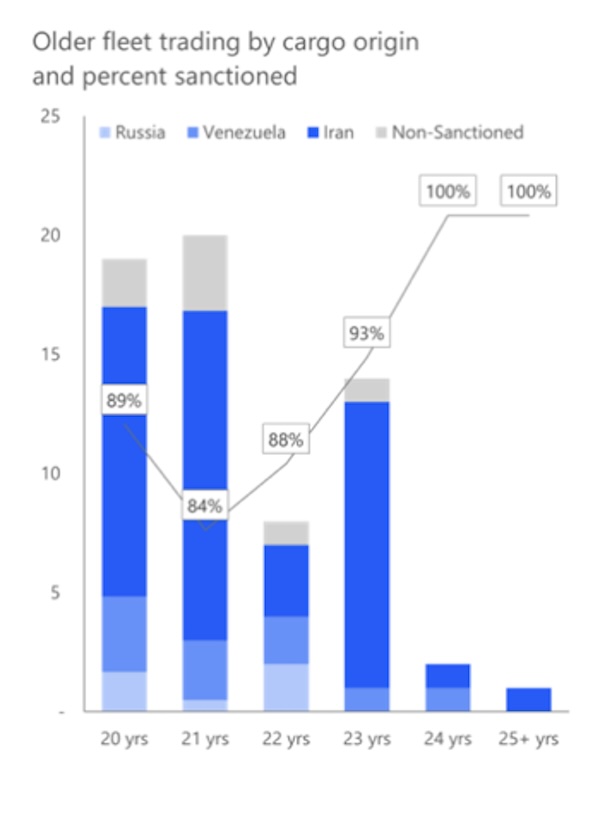

Although less efficient and past the traditional retirement age, vessels of 20 years and over are now used for sustained employment in less regulated markets, often transporting crude from sanctioned nations, where there is minimal scrutiny on vessel age, safety and emissions standards.

In the past, if vessels remained in the commercial space beyond the 20-year life span, it would be for storage purposes, or they would be inactive but not scrapped. Currently, of the vessels still in the commercial space and falling within the older age category, around two thirds are actively trading, with close to 90% of these operating within sanctioned business loading Russian, Iranian or Venezuelan oil.

These vessels are effectively permanently removed from circulation, unlikely to return to mainstream tanker markets due to their tainted past activity, poor maintenance and opaque ownership structure.

Declining efficiency

While more older ships are actively trading today beyond the 20-year lifespan, there follows a sharp drop in efficiency and therefore utilisation capacity, and a shift to shorter routes, compared to their modern counterparts.

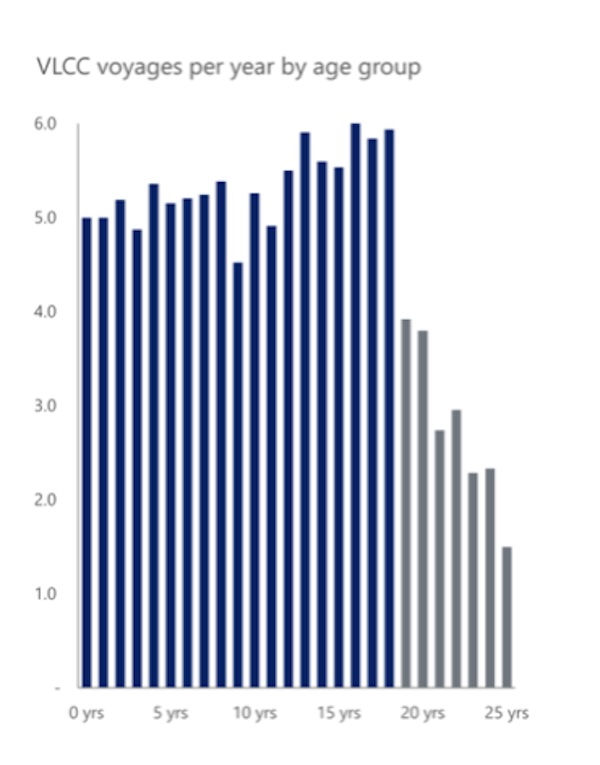

Younger VLCCs under 13 years of age can maintain consistent trade patterns, with an average of just over five voyages annually, often loading in theAtlantic Basin for longer voyages discharging in the Far East.

But as ships get older, increased restrictions and stricter limitations force these vessels to trade over shorter routes from the Middle East to the Far East, raising their voyage count to closer to six per year.

As the ships age, they will see some drop in efficiency, with more downtime and periods spent waiting for trading opportunities. After 18 years, the decline in efficiency accelerates, with vessels finding their employment drop by about 10% each year as age-restrictions imposed by charterers begin to impact their tradability. For ships trading outside sanctioned business, utilisation dwindles to almost zero by the age of 20.

Drag on effective supply growth

The impact of the ageing fleet and corresponding efficiency losses on the overall market is most pertinently reflected in true operational growth and effective supply growth of the VLCC fleet. While a modern VLCC performs just over 5 voyages in a year, its older-age counterpart will perform only two or three. Consequently, when the fleet’s growth is concentrated in these less efficient, older vessels we must consider their diminished cargo throughput relative to their modern counterparts when talking about effective fleet growth.

With sanctioned trade excluded, the effective number of vessels available for efficient trading and viable for mainstream crude transport remains tight, despite an expanding fleet.

In this imbalanced market scenario, competition for available tonnage intensifies, with stagnant vessel supply and the removal of sanctioned VLCCs from circulation causing an upward trajectory for freight prices.

Leveraging fixture data

Tankers International’s proprietary VLCC fixture data clearly reflects the increasing number of ageing vessels in the fleet, the underlying factors contributing to the fleet profile and the impact on the balanced fleet dynamic, effective capacity and overall market.

We have a fixture database housing 25 years of data, amounting to more than 100,000 recorded voyages, enabling us to access and interpret a large volume of accurate data and present meaningful insights to all our pool partners.

Our partners can capitalise on opportunities for growth using our knowledge to effectively navigate the current challenges facing the industry. We provide a forum for owners to discuss and find solutions to critical issues, such as the aging global fleet and other factors causing operational difficulties, including environmental regulations, crew availability and other unpredictable market cycles.

Those involved in tanker pools have an advantage, as they can gain insights into market trends, enabling informed decisions and the ability to respond more quickly and effectively in times of market volatility and uncertainty. With evolving broader geopolitics, particularly U.S. and Russia-China dynamics, contributing to an ever-changing maritime landscape, agility and informed decision-making has never been more essential.

Source: Mette Frederiksen, Head of Research and Insight, Tankers International, Arranged exclusively for Hellenic Shipping News Worldwide ().