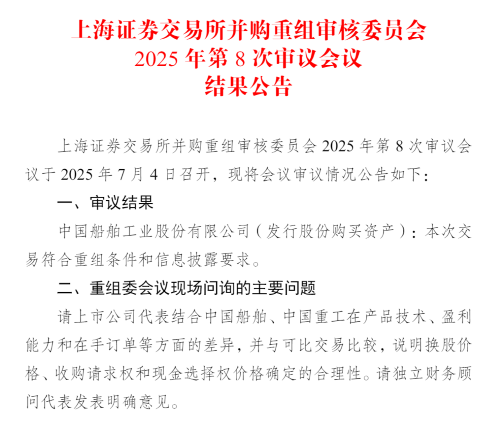

On July 4, the merger transaction between two flagship listed companies under China State Shipbuilding Corporation (CSSC), each with a market value exceeding 100 billion yuan, was approved by the Shanghai Stock Exchange, meeting the restructuring conditions and information disclosure requirements.

Total assets exceed 400 billion yuan! CSSC to absorb China Shipbuilding Industry Company (CSIC) via share swap

China CSSC Holdings Limited (CSSC) plans to absorb and merge China Shipbuilding Industry Company Limited (CSIC) by issuing A-shares to all shareholders of CSIC. The transaction is subject to registration by the China Securities Regulatory Commission and other necessary approvals, filings, or permits (if required) before formal implementation.

In this transaction, CSSC is the absorbing party, while CSIC is the absorbed party. After ex-rights and ex-dividend adjustments, the swap ratio is set at 1:0.1339, meaning each CSIC share can be exchanged for 0.1339 CSSC shares, with CSSC’s swap price at 37.59 yuan per share and CSIC’s at 5.032 yuan per share.

Upon completion of the share swap absorption, CSIC will delist and dissolve its legal entity status, while CSSC will inherit all assets, liabilities, businesses, personnel, contracts, and other rights and obligations of CSIC. The A-shares issued by CSSC for this transaction will apply for listing and trading on the Shanghai Stock Exchange’s main board.

It is reported that in September last year, CSSC and CSIC jointly announced a restructuring plan worth 115.15 billion yuan. This transaction marks the largest restructuring project in the history of China’s A-share market and the biggest merger in the global shipbuilding industry to date.

In January this year, the draft merger report was released, with the restructuring plan approved by both companies’ boards. The State-owned Assets Supervision and Administration Commission (SASAC) and other authorities have endorsed the overall plan in principle. On February 18, extraordinary general meetings of CSSC and CSIC voted overwhelmingly in favor of the merger proposal.

The transaction aligns with the central government’s strategy to deepen state-owned enterprise reform. By consolidating shipbuilding and repair businesses under CSSC, the merger aims to enhance operational quality, core competitiveness, and shareholder value while addressing industry competition concerns.

Post-merger, the surviving entity CSSC will continue to prioritize national defense while seizing opportunities in industry transformation. It will drive the shipbuilding sector toward high-end, green, smart, digital, and standardized development, aiming to become a globally competitive leader.

After the transaction, CSSC’s total assets will exceed 400 billion yuan, with annual revenue surpassing 130 billion yuan, making it the world’s largest and most comprehensive listed shipbuilder. This will solidify CSSC Group’s position as a global industry leader.

Hudong-Zhonghua integration imminent: “North-South Ship” merger to create “World Shipbuilding King”

Public records show CSSC is currently 44.47%-owned by China State Shipbuilding Corporation Limited (CSSC Group), while CSIC is 34.53%-owned by China Shipbuilding Industry Group Co., Ltd. (CSIC Group). Both parent companies are wholly owned by China State Shipbuilding Group Co., Ltd. (CSSC Group).

Post-merger, the controlling shareholder remains unchanged, with ultimate control resting with SASAC.

The CSSC-CSIC merger continues the “North-South Ship” consolidation initiated in 2019, when the two groups merged under the newly established CSSC Group. Ownership transfers were completed in October 2021.

Currently, both CSSC and CSIC are core listed entities of CSSC Group. CSSC focuses on marine equipment and technology, with subsidiaries including Jiangnan Shipyard, Waigaoqiao Shipbuilding, Chengxi Shipyard, and Guangzhou Shipyard International. CSIC specializes in naval R&D and manufacturing, with subsidiaries like Dalian Shipbuilding and Wuchang Shipbuilding.

In 2024, CSSC secured orders for 154 ships (12.7246 million DWT), while CSIC won orders for 103 ships (15.8995 million DWT). Combined, they accounted for 16.84% of global new orders by DWT.

To further avoid competition, CSSC Group has committed to preparing Hudong-Zhonghua Shipbuilding for injection into CSSC within three years.

Fully owned by CSSC Group, Hudong-Zhonghua is a global leader in LNG carrier and ultra-large container ship construction. Clarksons data shows it ranked second globally in 2024 new orders by CGT, with 85 vessels (10.4525 million DWT) in its backlog, including 56 LNG carriers.

Notably, Hudong-Zhonghua secured all 24 Q-Max LNG carriers (271,000 cubic meters each) in the second phase of Qatar’s “100-ship program,” setting a Chinese record with unit prices of $305-310 million.

Currently, Hudong-Zhonghua holds the world’s fourth-largest orderbook by shipyard and leads globally in LNG carrier orders (56 vessels), surpassing South Korean rivals.