Research by The Strategy Works discovers the importance of accurate global data on ocean currents and tides to optimise ship routeing

Spiralling global fuel costs coupled with regulatory pressures on emissions control, notably IMO’s measures to cut carbon intensity and the European Union (EU)’s proposal to add shipping to its Emissions Trading System (ETS) from 2023, collectively drive the appetite for fully integrated weather and fuel economy routeing data.

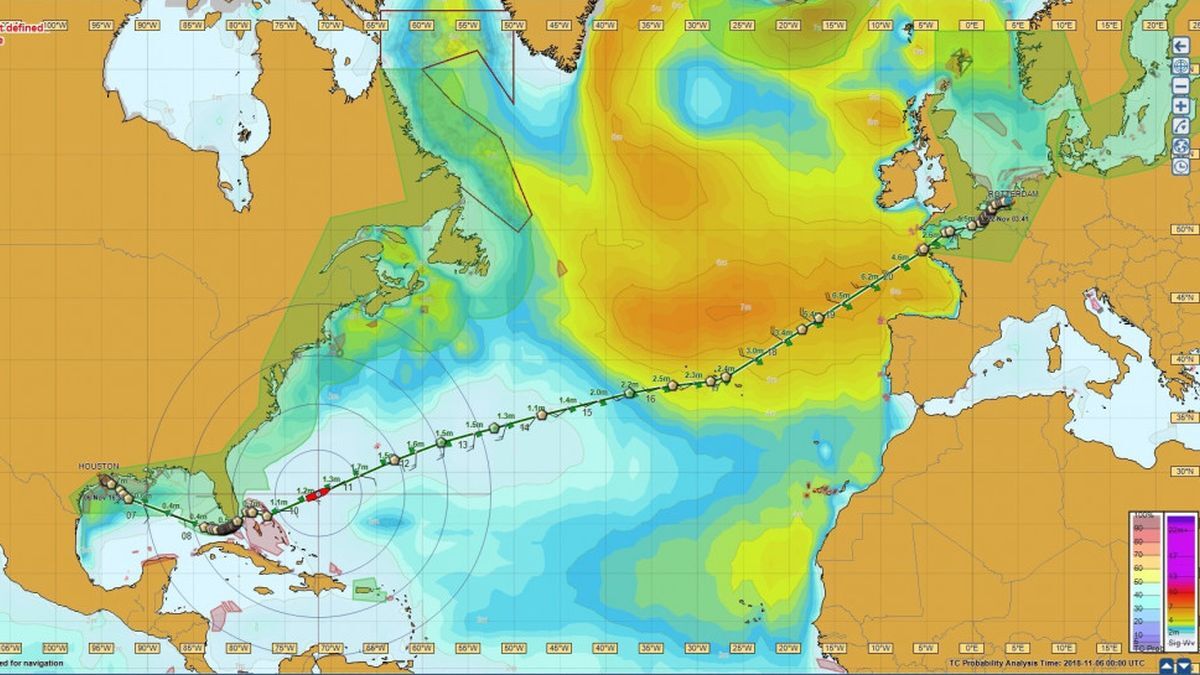

As Carnival UK nautical and marine safety superintendent Richard Smith explains, “We can import our planned routes into the voyage optimisation software, and it will show what currents we are predicted to have against us for each leg of the route. As part of the same integrated package, we get wind, meteorological data, water temperatures and ocean currents data.”

To discover how tidal and ocean currents fit into this evolving, modelling landscape, London-based marine strategy consultancy The Strategy Works (TSW) carried out indepth research with service providers and shipping companies across the value chain.

The overall data landscape for commercial use is split into the mandatory versus the non-mandatory market.

Tidal height data is mandatory, deemed essential for safe port entry, so it must be sourced from national hydrographic offices when used for commercial navigational purposes.

For the leisure market, data is available ‘open source’ from more than 25 regional providers in the UK, EU and Asia-Pacific region for non-commercial use and academic and scientific purposes.

Vessels use tide tables and tidal currents maps (mostly digital, but also printed) for passage planning. These are principally sourced from the UK Hydrographic Office (UKHO), which models and aggregates mandatory tidal height data sourced from global hydrographic offices, under their Admiralty Total Tide brand.

Vessels increasingly use digital passage planning systems, some of which provide access to tidal data within the software. Many digital route planning systems include an under-keel clearance calculation functionality.

In contrast, tidal currents data (information on the flow of water caused by tidal height differences), when used for weather routeing, voyage optimisation or performance-monitoring purposes, is non-mandatory and not required to be carried as official data.

Multiple weather data and voyage optimisation service providers target shipping, offering ready-to-use weather and ocean currents data for use within voyage optimisation services, some of which also include tidal effects in their ocean currents datasets.

Spliethoff business innovation and data analyst Max van den Berg says there are issues with availability and quality of tidal and currents data. Spliethoff operates more than 100 vessels requiring tidal and currents data during voyages.

“Some local tidal models are good, but the availability of high-quality data for all regions is not always easy, or are scattered over different providers,” says Mr van den Berg.

“There are some providers with a focus on tidal currents data like TideTech, but a solid high-quality, high-resolution source of global tidal currents data is hard to find.”

Weather information provider DTN shipping product specialist Karan Bhawsinka agrees there are data gaps.

“Tidal currents data is available for open ocean only,” he says. “For the current flow information inside ports, there is no global dataset available. This is modelled on a case-to-case basis using specialised software tools.”

Data type and sources

Ocean currents data (the flow of water caused by forces stemming from weather systems and differences in density) is also non-mandatory and principally used during passage planning to improve a vessel’s operational performance.

Up-to-date ocean currents forecasts are available via subscribed services from weather forecasting service providers and are typically bundled with other more critical metocean parameters, such as wind speed and direction, pressure fields etc.

Intermediate users of metocean data include providers of services such as weather routeing, voyage optimisation and performance monitoring.

These companies typically incorporate metocean data into a package with additional modelling to provide this either directly to shipping customers, or via their value-adding resellers, which include distributors of electronic navigational charts.

Two global modelling providers are cited multiple times in the research as the leading original sources for ocean currents – Mercator Ocean International and HYCOM.

Mercator is backed by the European Center for Meteorology and Weather Forecastsand its outputs also include some tidal elements.

The HYCOM consortium is a multi-institutional effort sponsored by the National Ocean Partnership Program. It has the backing of the US Navy and National Oceanic and Atmospheric Administration.

To illustrate an added-value modelling example, Australian company TideTech creates regional and local resolution tidal current models and combines those outputs with the global ocean currents outputs produced by Mercator and HYCOM.

Mr Bhawsinka recognises the importance of ocean currents in reducing emissions, which has become a “front-of-mind issue today” for shipping companies.

“Knowledge of ocean currents becomes more important for voyage planning as the fuel price increases and changing regulations require ships to drastically reduce emissions,” he says. “Sailing in the wrong currents can be costly to the company and the environment.”

Increasing data integration

TSW’s research focused principally on ocean currents, but other external commercial forces are now in play, all driving shipping’s thirst for data integration.

Shipping’s orientation towards a one-bridge solution is a high connect with stakeholders across the landscape, who expressed a strong desire for single systems.

“Bridge system integrators are starting to provide an integrated one-bridge solution, which connects ships to the shore office of the company and to ports, providing a seamless user experience on board and ashore,” says Mr Bhawsinka.

“At DTN, our strategy is to build innovative solutions that easily integrate with these systems,” he says.

“We are developing application programming interfaces (APIs) that harness the power of the latest weather and ocean flow modelling technology, nautical science, routeing, naval architecture and advanced data analytics to feed those integrated systems on board and onshore.”

Growing onshore collaboration and influences was another strong connecting theme identified in the TSW research. This was highlighted by StormGeo chief product and technology officer Svenn Owe Haugland.

“The future depends on the route optimisation being connected to a very strong real-time shore operator component,” he says.

“This is driven by complex new demands on emissions control and reductions and evolvement of advanced data analytics on real-time and available vessel performance data.”

He cites providers of these data services such as ZeroNorth and OrbitMI. This data is “evolving around the shore operator’s commercial optimisation component,” says Mr Haugland.

Increasingly sophisticated weather modelling is another strong connect from the research as Mr Bhawsinka explains.

“We use an ensemble of meteorological and oceanic models, using proprietary and public data, such as Mercator and HYCOM, combined with machine learning to deliver our insights,” he says.

“This method improves accuracy, which translates into more actionable insights. While the ensemble method processes terabytes of information through computing power; technology, such as APIs, makes it possible to deliver these insights directly through integrated systems.”

Data modelling relationships

The opportunity to add value positions the leading actors across the four main segments of the value chain: modelling, products, services and distribution.

Some actors are visible in all four segments; others specialise in modelling or specific products and services. This includes post-processing of global models, regional and national models, mixing ocean with tidal currents etc.

The non-mandatory tidal and ocean currents market is built on technology alliances and commercial relationships; virtually no one is going solo.

During this research, TSW discovered over 70 suppliers with collaborative customer relationships or named partnerships within the weather modelling and voyage optimisation space.

Many of these companies work conscientiously in the background, adding value by deploying their integrated modelling tools.

TSW identified StormGeo and DTN as two principal weather and route optimisation providers, although it is recognised there are others. StormGeo and DTN have similar end objectives, but they diverge in their route to market.

DTN is a global data, analytics, and technology company. Through its marine content services, it provides marine weather, vessel insights and vessel routeing APIs, which can be integrated into existing systems or through a one-point solution.

Mr Bhawsinka says this makes it easier for ship operators to access and get a more complete picture of the current situation. Customer examples to whom DTN licenses its shipping solutions include OrbitMI and OneOcean, under its own label.

StormGeo, through its s-Suite portfolio, is approaching this by connecting its route advisory services and /onboard cargo and vessel safety route optimisation solution, incorporating BVS, to the shore operator’s commercial optimisation platform. This provides a holistic safety, emissions and cost-efficient voyage optimisation approach.

Mr Haugland explains continuous onboard and shore commercial decisions are fuelling this data collection capability.

He says the basis of the StormGeo approach to the solution is through advanced artificial intelligence and analytics and a connected ship (s-Planner); shore (s-Insight) and service component (s-Routing).

“This enables a collaborative environment between ship and shore personnel,” says Mr Haugland. “This digital twin approach also permits other valuable use-cases such as technical performance surveillance and predictive maintenance.”