The Logistics Managers’ Index (LMI), a measure of overall supply chain conditions, dipped 2.5 percentage points from April to 67.1 in May. A reading above 50 indicates expansion while a reading below 50 indicates contraction.

The transportation capacity subindex jumped 7.8 points to 64.7. That was the sharpest rate of expansion in the data since October 2019, “as the logistics industry continues its regression towards the mean after nearly two years of rapid growth,” the report read.

The index is now 20.3 points higher than the February reading. The change is evident in ’ Outbound Tender Reject Index. Loads being rejected by carriers have fallen to just 9% compared to readings north of 20% throughout 2021.

Transportation utilization was flat at 64.3 during the month but the rate of growth in the pricing index slowed, down 8.6 points from April to 65.3. This was the slowest rate of growth in the prices data set since June 2020. However, the trend for rates is unlikely to turn negative as survey respondents indicated a value of 68.4 in a year from now.

“Despite this slowdown, it should be noted that we are still observing a healthy rate of growth in transportation, but one that pales in comparison to the unsustainable growth rates observed in 2021,” the report stated.

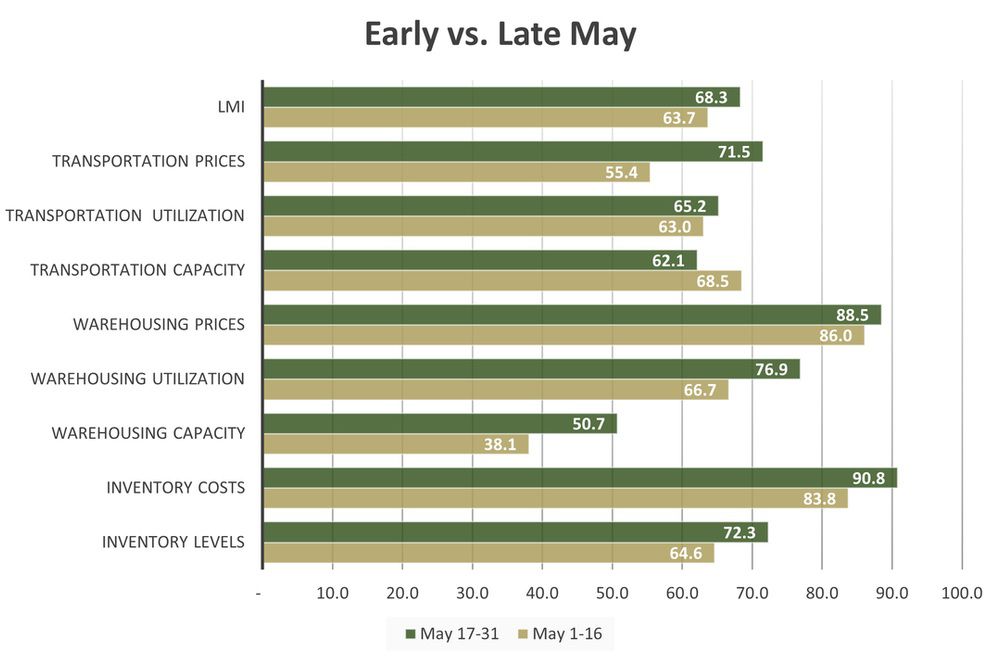

Additionally, the second half of May heated up. The pricing index was 16.1 points higher in the last 15 days of the month. Capacity growth slowed and utilization ticked higher.

“While there is often some seasonal contraction in capacity around Memorial Day, the size of the change suggests there could be more underlying the change,” the report added.

Chart: LMI

Chart: LMI

Inventories growing at a slower rate

The report showed that inventory levels, while still expanding (69.3), did so at the slowest rate so far this year. The level was well off the 80.2-reading logged in February but still 10.6 points higher than a year ago. Also, the inventory growth rate accelerated 7.7 points in the second half of the month. “This means that seasonally speaking, inventories continue to increase more quickly than we would normally expect at this point of the year,” the report said.

The inventory costs subindex ticked slightly higher to 88.1. Costs have remained historically high over the last year but the composition has changed. “In 2021 costs were high due to the velocity at which goods were moving; in 2022, the costs are due more to the static buildup of goods.”

“Despite Amazon’s temporary pause, the industrial real estate sector remains hot as firms that may have been boxed out by Amazon and other large retailers now find an opportunity to acquire space of their own.”

Warehouse utilization (72.9) stepped 2 percentage points higher and the pricing data set (87.5) was 1.7 points higher.

“It will be important to continue observing transportation in the coming months to understand if the spike in prices and dip in capacity in late May are indicative of the freight market leveling off, or are just a reprieve in an ongoing dip,” the report concluded.

The LMI is a collaboration among Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University and the University of Nevada, Reno, conducted in conjunction with the Council of Supply Chain Management Professionals.