Trucking companies in the Walmart Transportation network have begun receiving emails about Walmart’s new third-party logistics offering. This initiative signals the retailer’s deepest expansion into freight services that it announced in August, leveraging its existing logistics network as an offering for its Walmart sellers.

The emails, sent to selected operators, introduce the Walmart brokerage program and outline the benefits of participation.

“We are connecting with a select group of operators like you to embark on an initiative that will transform how we deliver to our customers. By joining us, you will have the opportunity to secure consistent freight and play a crucial role in ensuring our freight reaches all our customers,” said the email obtained by Freightwaves.

Operators are directed to a website to begin the onboarding process, with additional guidance provided as they complete each step. The communication invites interested operators to make contact for further details.

To qualify, carriers must meet requirements that include operating more than 10 but fewer than 1000 trucks, maintaining at least five consecutive years of operating authority, and carrying $1 million in liability insurance and $100,000 in cargo insurance. Furthermore, carriers must have 53-foot dry vans, reefers, or flatbeds, comply with Walmart’s safety standards, whose details FreightWaves has not confirmed, and ensure that drivers use smart devices for tracking purposes.

Sources close to the new service say that Walmart’s brokerage segment is still in stealth mode, as it takes its first steps to become a competitor in the 3PL space.

The business effort falls under Walmart Fulfillment Services (WFS) which holds broker authority under MC#1096733 and freight forwarder authority under FF#37548. Walmart announced last year its freight forwarding services, focused on cross-border shipments and other international shipments for its marketplace sellers.

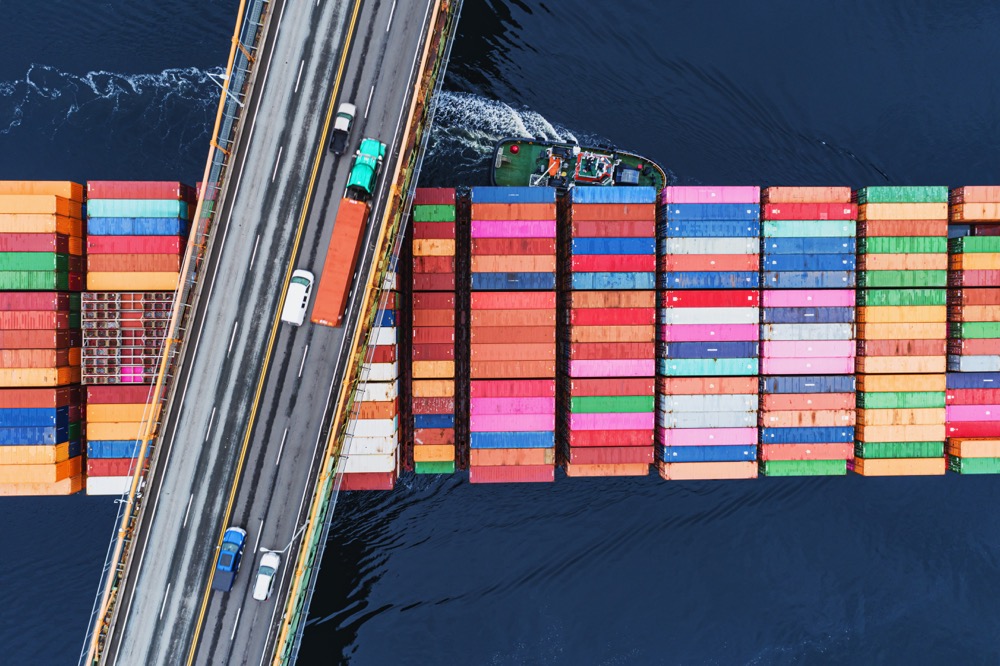

Walmart’s entry into brokerage has significant implications for the 3PL industry. By leveraging its vast logistics infrastructure and private truck fleet, one of the largest in North America, Walmart could disrupt traditional brokerage models. The retailer’s ability to consolidate freight from its marketplace sellers and integrate it with its existing distribution network may present an attractive value proposition for shippers seeking cost-effective and reliable logistics solutions.

The expansion also marks another step in Walmart’s ongoing competition with Amazon.

Walmart Fulfillment Services positions itself as an alternative to Amazon’s Fulfillment by Amazon (FBA), allowing third-party sellers to utilize Walmart’s storage and shipping capabilities. As more sellers migrate their inventory to the Walmart ecosystem, Amazon could see a decrease in the volume of freight moving through its logistics network. A key differentiator for Walmart is its extensive network of physical stores, which serve as mini-fulfillment hubs.

This allows for faster last-mile delivery and reduced transportation costs compared to Amazon’s reliance on regional fulfillment centers and its Amazon freight network.

Amazon’s FBA model has faced criticism for high storage fees and long-term penalties, while Walmart has positioned WFS as a cost-effective alternative with a simpler price structure.

With Walmart GoLocal already offering last-mile delivery services for third parties, integrating this with its freight brokerage operations could create an end-to-end logistics solution that rivals Amazon’s same-day and next-day delivery capabilities.

Despite Walmart’s rapid expansion in logistics, Amazon maintains a significant advantage with its dedicated air fleet, ocean shipping, and an extensive network of third-party carriers. However, if Walmart strategically scales WFS, it could be a fierce competitor for Amazon and the entire North American 3PL industry.

Timothy Dooner contributed to this report.

This is a developing story.

EntreTR cofounder launches ‘AI Teammate’ for Logistics, raises $25 million

Transflo releases next-generation workflow automation solution for carriers

Global manufacturing is repositioning, but it’s complicated

The post Walmart moves forward with brokerage: what it means for Amazon appeared first on FreightWaves.

…

Continue reading the FreightWaves article here