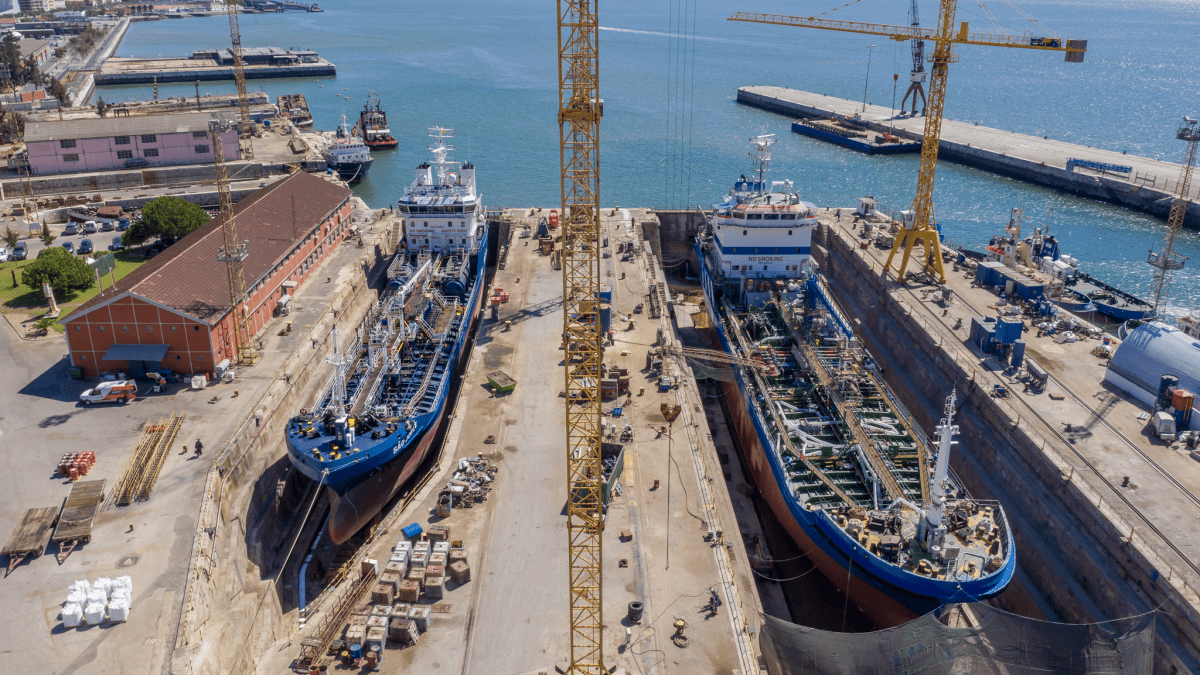

Activity in Europe: tankers undergoing retrofit installations at Portugal’s Navalrocha Shipyard (source: Navalrocha)

Activity in Europe: tankers undergoing retrofit installations at Portugal’s Navalrocha Shipyard (source: Navalrocha)

Pockets of tanker construction can still be found across Europe despite the dominance of the Far East shipyards, but the invasion of Ukraine is having an impact on demand for newbuildings

Shipbuilding in Europe has declined significantly in the last three decades and it will come as no surprise that there are more tankers on order in South Korea alone than in all the shipyards in Europe.

The Netherlands has the largest number of tankers on order with 37 tankers, comprising 34 at Concordia Damen, Ferus Smit (3), and GS Yard (1).

The Concordia Damen shipbuilding group is in the midst of one of the most exciting shipbuilding projects in Europe, involving a series of Parsifal project inland waterway tankers operated by a joint venture between the VT Group and Marlow Navigation. These have been financed by institutional investors advised by JP Morgan Asset Management. The project is underwritten by a long-term charter to Shell. The lead vessel, Blue Marjan, underwent sea trials in December 2021.

The Parsifal tankers, all pre-fixed “Blue”, consist of hulls constructed at the Kladovo shipyard in Serbia. Concordia Damen technical manager Bert Duijzer told Tanker Shipping & Trade that the schedule is for one hull to be delivered every 40 days. It is a project that requires strong partners, with Concordia Damen providing a trio of strong collaborative points: “First, we have the scale, second the backing of Damen, and third, we have a very good design,” said Mr Duijzer.

He noted that the rivers of Europe have become shallower in the last decade and the 110 m long tankers have extremely shallow-draught capabilities – 2,800 tonnes on around 3.25 m draught – to maximise cargo-carrying capacity on Dutch, Belgian and German canal and river networks.

“First, we have the scale, second the backing of Damen, and third, we have a very good design”

“In principle, we were producing 40 ships,” said Mr Duijzer, “but [because of] the price of LNG and the geopolitical situation in the world, it has been decided to stop [production] at 20.”

Since 2000, Turkey has been a popular provider of smaller tankers, especially those with MarineLINE tank coatings. Altogether, there are 15 tankers on order in Turkey, with five at ICDAS, two at Istanbul Shipyard, and one at Ceksan.

The ICDAS shipyard in Turkey is producing state-of-the-art tankers with multifuel engines, an optimised hull shape, and battery and shore-power connections for Norwegian operator Utkilen. These are part of Utkilen’s strategy to meet ambitious decarbonisation goals in the Baltic trades.

Deliveries will commence in 2024 with Høglund Marine Solutions CAN MAKINA, a Turkey-based maritime engineering and manufacturing company, providing the integration with Høglund’s power management and electrical systems. LNG is a key element of Utkilen’s decarbonisation strategy, in addition to the possibility to use liquid biogas to further reduce the impact of greenhouse gases. Høglund will also supply the ships’ FGSS

Høglund’s integrated automation system will provide crewmembers with full access to the vessel’s operational data, generated from individual inputs and outputs, which they can use to analyse and optimise the ship’s performance.

Høglund president Børge Nogva said: “Our experience and expertise in developing integrated automation and control systems that make vessels more environmentally friendly is integral to this project. We are excited to work with Utkilen, the yard and suppliers in this project to deliver ships that steer the maritime industry towards a greener future.”

Utkilen chief executive Siri-Anne Mjåtvedt added: “We have owners who invest long term. In a time of great uncertainty in relation to future green technology, we choose to make large investments that will considerably reduce our carbon footprint.

“In a time of great uncertainty, we choose to make large investments that will considerably reduce our carbon footprint”

In Romania, Santierul Naval Constanta (SNC) shipyard is building three tankers for Histria Shipmanagement. As detailed in the /July 2019 issue of Tanker Shipping & Trade, the continued existence of the shipyard is down to the energy of Gheorghe Bosinceanu, a master mariner who has been instrumental in the revival of shipping in Romania. In 2002, he took over the SNC shipyard and ordered a series of IMO 3 /chemical tankers in the 37,000-dwt to 41,000-dwt range. Mr Bosinceanu has supported the yard with further orders.

There are also three 3,000 dwt tankers on order in Poland, contracted by Belgium-based Plouvier Transport. However, the status is unknown regarding the 4,600 dwt tanker Gloster 2, which is under construction at Khersonskiy Zavod Pallada shipyard. The yard is located in Kherson, which has been at the centre of Russia’s fight for control in the region.

Spain has one of the oldest traditions of shipbuilding in Europe, but currently there is only one tanker under construction. Astilleros De Murueta shipyard in northern Spain has a similar business model to SNC in Romania in that the bunker tanker under construction is for a family that has shipping and ship construction interests in the region. Astilleros De Murueta shipyard has been in operation since 1943.

While no tanker newbuildings are under construction in Portugal, the Navalrocha Shipyard in Lisbon reports a busy 2022 so far, with one of the world’s largest operators of bunker tankers sending two MM Marine vessels, Symi and Kithnos, for BWTS installation work, combined with general repairs including blasting, painting, piping and mechanical work. Navalrocha also hosted the Italian-flagged Bice Amoretti /chemical tanker, owned by the Amoretti Armatori Group, which visited for a 16-day reclassification, involving mechanical and propulsion work, a main engine overhaul and BWTS installation.

Navalrocha commercial director, Sergio Rodrigues, expounded on the advantages of Navalrocha and its location: “Our yard continues to drive expansion in key growth markets including chemical tankers and LPG carriers,” he said. “Both areas hold major potential due to our strategic location, close to the industrial port hub of Sines, which has an ever-growing global profile as the gateway to Europe. We are also well positioned for vessels travelling to ports further north, including Aveiro and Viana de Castelo.”