US CPI, China inflation, trade figures and UK GDP

A busy week ahead for economic releases is expected with the key focus on US and China inflation figures for October. China will also update October trade figures. The United Kingdom meanwhile releases third quarter GDP figures while Germany’s industrial production data will also be due. A series of central bankers’ appearances, including those from the US Federal Reserve will be watched intently after this week’s Fed FOMC meeting.

The market witnessed another 75 basis points hike by the Fed this week, but it was unsurprising indications of the path forward that were the highlights. Amid hints of continued, albeit smaller, hikes in upcoming meetings aimed to prevent a “very premature” pause in tackling inflation, stock prices slipped in the Wednesday session. Fed Chair Jerome Powell’s emphasis on incoming data guiding the central bank in further tightening also doubled down on the importance of inflation numbers in shaping the road ahead, which was within our expectation. Next week’s consumer price index (CPI) data will therefore be of key importance with any deviation from the consensus potentially market moving. As far as the S&P Global US Composite PMI suggested, the easing of output charge inflation was seen in October for the private sector which is in line with consensus expectations of slowing core CPI growth. Next week’s S&P Global Investment Managers Index will also shed light on money managers’ views with regards to the US equity market.

Outside of the US, UK monthly output figures will capture the market’s attention following a period of heightened volatility for the British pound. While the PMI data alluded to the potential for a third quarter contraction, official data will be watched for the extent of deterioration. Meanwhile China’s inflation and trade data will further outline the extent to which lingering COVID-19 restrictions have affected economic conditions.

Gloomier picture for global goods producers

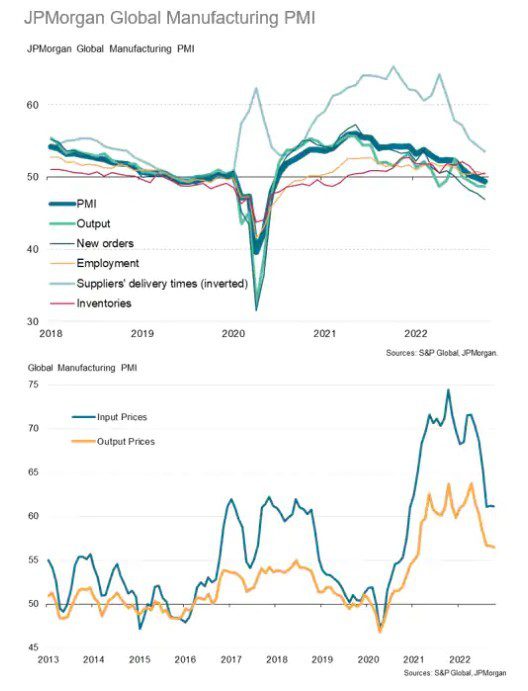

The global manufacturing sector’s downturn deepened according to the latest JPMorgan Global Manufacturing PMI. A faster contraction of output was recorded in October with faster contraction of demand and output. Various key economies, including the US, UK and eurozone signalled continued contraction at the start of the fourth quarter, outlining the heightened recession risks faced.

Moreover, concerns on prices extends, with the latest input costs and output prices data pointing to moderating but still elevated inflation, a key concern for global central bankers.