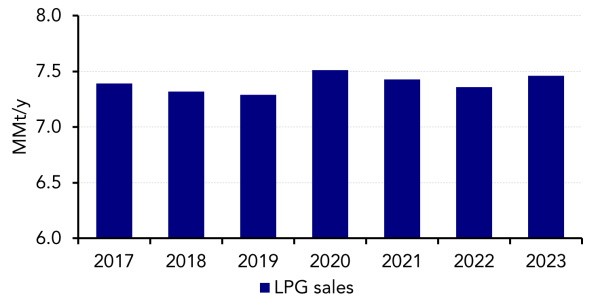

Brazil’s LPG sales (~consumption) is estimated to be around 7.35 MMt in 2022, down 1% from the previous year and 2% below 2020, according to Brazil’s Energy Research Office EPE. The small drop is mainly due to year-over-year increases in international prices which also increased the domestic price.

Most of the LPG demand in the country comes from residential cooking. Consumption in the sector rose sharply in 2020 as households used more cooking fuel during Covid-19 lockdowns. Disbursements of emergency social payments in that year also boosted consumption.

However, some of the jump in residential demand was offset by lower industrial demand. Demand stayed robust in 2021, supported by subsidies as well as higher demand from the service sector, especially from restaurants following reopening. Demand has normalized in 2022.

There were concerns whether rising international prices and high inflation would weigh on consumption; however, the extension of some government subsidies for low-income households helped offset higher prices.

Brazil’s oil and fuel prices, including LPG increased considerably in the first half of 2022, mainly due to the ongoing conflict between Russia and Ukraine. Rising global demand also pushed international prices higher, having a ripple effect on domestic retail prices in 1H 2022.

Prices trended lower in 2H 2022 which translated into an average 10% increase in domestic LPG price compared with 2021, according to the national oil and gas regulator ANP.

The Brazilian government extended some fuel-subsides to low-income households under amendments to the constitution through the end of 2022.

Under this law, low-income households were given supplemental assistance to buy LPG. Some of these subsidies are expected to continue in 2023.

Subsidy

Brazil’s lower house in late-2022 approved an increase in the government spending cap for the incoming president Luiz Inacio Lula da Silva for 2023.

The new amendment will maintain the social welfare programs in 2023 for low-income groups and should keep LPG demand steady.

However, all the government assistance may not go into buying LPG since it is a cash payment, and the recipient could spend it for other needs amid high inflation.

The spending increase must be approved by the lower house in a second vote and by the senate.

The lower house approved the spending increase only for 2023 even though the senate proposed it for two years. If it is not extended for 2024 then the subsidies will be reduced next year.

Petrobras divestments & supply risks

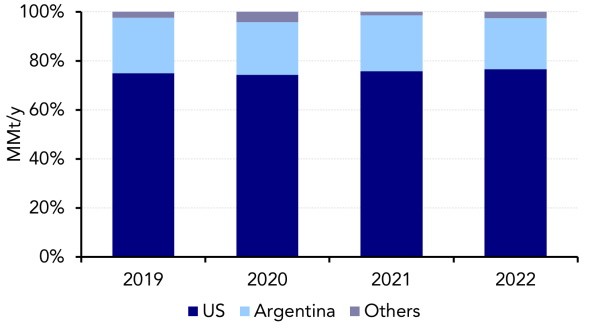

In recent years nearly 70% of LPG demand in the country has been met with domestic production, according to ANP.

Poten estimates more than 80% of Brazil’s LPG production currently comes from refineries and the rest from gas processing and petrochemical plants. Historically, Petrobras owned about 98% of the country’s 2.3 /d refining capacity and supplied 95% of LPG produced in the country. Currently, Petrobras owns about 80% of refining capacity following the sales of some refineries. This ratio will decline further in the coming years which could increase reliance on imports.

Back in 2016, Petrobras announced its “Portfolio Optimization Program” in a bid to reduce debt and focus on its core business of exploration and production (E&P). The plan includes selling nearly 1.1 /d, or nearly 50% of the country’s refining capacity and other assets like pipelines or terminals.

The 333,/d RLAM refinery was the first divestment, completed in November 2021, although the sale and purchase agreement was made in 2017. Late last year the company completed the divestment of the 46,/d Isaac Sabba refinery and has plans to divest up to $20 billion of assets between 2023-2027, including six other refineries.

The divestment process is taking a long time and has faced many delays since the announcement because of unqualified buyers, qualified buyers failing to submit binding bids and initial binding proposals not meeting economic-financial criteria.

There are concerns that a lack of maintenance during the divestment could result in lower production. How efficiently the new stakeholders will be able to operate the refineries initially is also a concern which could result in lower refinery LPG supply and increase reliance on imports.

On the positive side Petrobras continues to invest in the refinery assets that are not under divestment plans and in E&P projects. The 252,000 /d Revap refinery, one of the largest in the country and not included in the divestment plan, produced record LPG and gasoline in 2022. The refinery supplied 11% of domestic LPG demand in 2022.

LPG imports by the private sector are also on the rise following Petrobras’ sale of the LPG distribution unit in late 2020. Investments in LPG terminals and other infrastructure by private companies have also increased.

Last year, SHV Energy, under its subsidiary Supergasbras, announced plans to develop two import terminals in the south of Brazil.

Meanwhile, the country could be on a path to decrease reliance on LPG imports with increased oil and natural gas production, and processing capacity during the second half of the decade.

In 4Q 2021, Petrobras released its Strategic Plan 2022-2026 with an increased focus on larger oil and gas fields in the deep and ultradeep waters in line with the divestment plan. The plan also includes efficiency gains.

Petrobras has already approved 15 new Floating Production Storage and Offloading (FPSOs) between 2023 and 2026 to drive production growth.

The Federal Government of Brazil projects oil production to increase to 5.2 /d in 2031 from 2.9 /d in 2021. Gas production is projected to increase to 276 /d from 134 /d which will significantly increase associated LPG production. These projections assume Petrobras and other international oil companies will continue to develop the best assets. Meanwhile, existing, midsize assets with declining production will be sold to smaller companies which would also result in higher production from these fields by enhanced recovery techniques implemented by the new owners.

The Brazilian government has its own projection, showing the country could be self-sufficient in LPG by 2030.

It is Poten’s view that a significant increase in investments will be required to achieve that level of production growth; however, imports will be lower by the end of the decade considering the higher domestic supply and marginal upside in LPG demand from the residential sector which accounts for most of the demand.

The domestic LPG industry is lobbying for some policy changes that would allow LPG use in other sectors that is currently prohibited; however, any meaningful demand growth from other sectors such as autogas, petrochemical or industrial will take a long time to develop and are not considered in Poten’s demand models.