This was supported by the sales of Capesizes, with the Wisdom of the Sea 1 and 2 (180,200 DWT, July 2011, Daehan) having been sold for USD 23.75 mil, VV value USD 24.49 mil, supporting a softening market.

Although there are still healthy amounts of sale and purchase transactions being reported, Bulker sales have declined by 28% from the same period last year. In Q4 2022, there have been 149 Bulker sales reported so far, compared to 206 in Q4 2021.

Tankers remain firm

Last Monday signalled the official introduction of the EU and G7 embargo on Russian oil and since then, Tanker rates have shown volatility. VLCC rates on the TD3 TCE Middle East Gulf to China route are currently at 52,619 /Day. Suezmaxes stand at 67,974,325 /Day, rates which are still very firm.

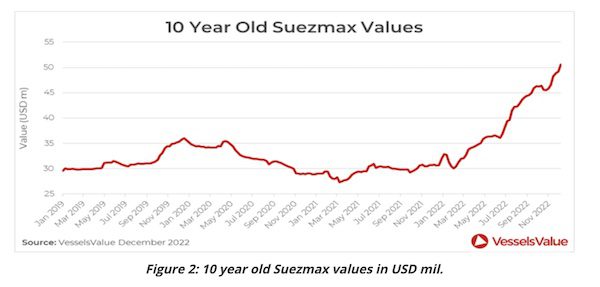

Values remain firm for the larger crude carriers. For example, Suezmax values for 10 year old vessels of 160,000 DWT are up by c.3% to USD 50.86 mil. Notable sales include the Ridgebury Mary Jane (150,000 DWT, May 2008, Universal),which was sold to undisclosed buyers for USD 39.5 mil, VV value 38.99 mil.

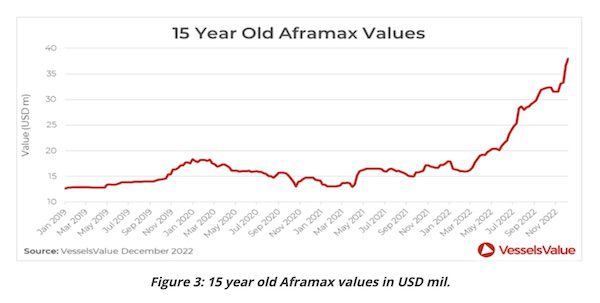

Older Aframaxes continue to firm in value, with fifteen year olds currently valued at USD 37.29 mil, up from USD 32.04 mil at the start of the quarter. These prices are supported by the Seatrust (114,600 DWT, July 2004, Samsung), which was sold to undisclosed buyers for USD 35 mil, VV value USD 31.79 mil. The Antaios (106,000 DWT, Jan 2006, Hyundai Samho Heavy Ind.) was sold to undisclosed buyers for USD 33.5 mil, VV value USD 33.21 mil.