Approximately 60% of the bulk carrier fleet is less than 10 years old (source: DNV)

Approximately 60% of the bulk carrier fleet is less than 10 years old (source: DNV)

Industry experts discuss challenges and strategies in retrofitting bulk carriers for alternative fuels amid decarbonisation imperatives and operational constraints in Riviera Maritime Media’s Decarbonisation of bulk carriers via retrofits webinar

The panel delved into the complexities of retrofit projects and explored strategies to ensure their effectiveness amid evolving market conditions and regulations.

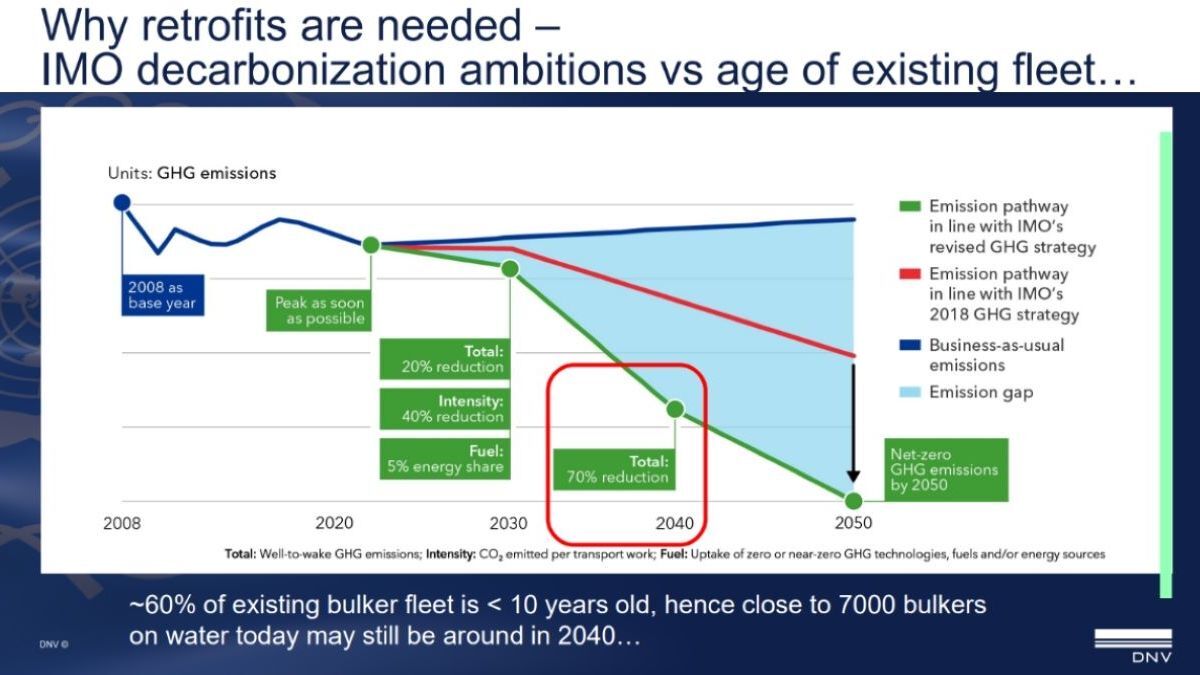

DNV Maritime global business director, vice president Morten Løvstad explained the drivers behind the decarbonisation imperative being experienced by dry bulk shipping.

He stressed the urgency of decarbonisation efforts driven by international regulations set forth by International Maritime Organization (IMO), highlightingthe ambitious targets aimed at reducing energy intensity by 70% by 2014, driving the need for innovative solutions in the maritime industry.

With approximately 60% of the bulk carrier fleet less than 10 years old, retrofitting existing vessels is crucial to achieving decarbonisation goals.

Mr Løvstad acknowledged the challenges associated with retrofitting, including the limited availability of alternative fuels such as ammonia and the readiness of engines for their use.He noted the importance of considering operational constraints, such as bunkering logistics and high operating expenses, which pose significant hurdles to retrofitting initiatives.

Despite the allure of alternative fuels, Mr Løvstad proposed a pragmatic approach, focusing on energy efficiency measures and sustainable biofuels as more viable options for existing vessels. He outlined various retrofit options, including machinery-related measures such as waste heat recovery and propulsion efficiency enhancements.

Lloyd’s Register lead consultant Jack Spyros Pringle provided insights into assessing the feasibility and viability of retrofit projects.

Mr Pringle stressed the importance of understanding emissions improvement targets and evaluating technologies based on their efficacy and payback periods.He highlighted the need for a holistic approach considering operational changes, biofuels, and fleet replacement plans alongside retrofit initiatives.

Verkis Consulting Engineers chemical engineer and project co-ordinator Freyr Ingólfsson introduced Project Gamma, a groundbreaking initiative aimed at achieving climate-neutral shipping. With a focus on retrofitting vessels with innovative fuel systems, Project Gamma aims to demonstrate the safe integration of green fuels to achieve substantial emissions savings.

Mr Ingólfsson highlighted the utilisation of technologies such as ammonia crackers and fuel cells, coupled with renewable energy sources, to power vessels.

He addressed safety and regulatory concerns associated with novel fuel systems, emphasising the importance of collaboration with classification societies and stakeholders, and outlined Project Gamma’s rigorous approach to ensure compliance and safety throughout the retrofit process.

As the dry bulk shipping industry navigates the complexities of retrofitting, collaboration and innovation emerge as key drivers of success.

By prioritising energy efficiency measures, evaluating retrofit opportunities, and addressing safety and regulatory challenges, stakeholders can chart a sustainable course towards decarbonisation in the dry bulk shipping sector.

Webinar poll results

For a 10-year-old Capesize operating in the spot market, what is the maximum capex you would consider for a retrofit to keep it attractive in the market?

Less than US$1M: 24%

US$1-3M: 44%

US$3-5M: 24%

US$5-10M: 4%

More than US$10M: 4%

Are you considering main engine conversions as part of your fleet decarbonisation strategy?

Yes: 42%

No: 58%

For a 15-year-old Supramax operating in the spot market, what is the maximum capex you would consider for a retrofit to keep it attractive in the market?

Less than US$0.5M: 23%

US$0.5 – 1.0M: 35%

US$1.0 – 2.0M: 27%

US$2.0 – 5.0M: 15%

More than US$5.0M: 0%

To what extent do you agree with the statement: investing in retrofitting my vessel to improve its efficiency will make it more attractive in the market

Strongly agree: 28%

Agree: 68%

Not applicable: 0%

Disagree: 4%

Strongly disagree: 0%

What is the main driver behind your retrofit projects?

IMO regulations: 46%

EU regulations: 12%

Corporate targets: 12%

Competitive appetite: 24%

Charterer ambition: 6%

Which aspect of alternative fuel retrofits do you consider the most challenging for widespread adoption in the maritime industry?

Economic viability and payback period uncertainty: 26%

Technical integration and operational complexity: 26%

Infrastructure and supply chain readiness: 48%

How important is it for retrofit solutions to prioritise operational flexibility and compatibility with existing vessel systems?

Highly important – retrofit solutions must maintain vessel flexibility and seamless integration: 45%

Moderately important – some trade-offs can be made for the sake of emissions reduction: 55%

Less important – the primary focus should be on maximising emissions reduction potential: 0%

Source: Riviera Maritime Media