The higher consumer demand and port congestion rises, the more container lines and leasing companies pay for newly manufactured containers, the higher the production of Chinese container factories, the longer liners lease containers, the more liners pay to rent them, and the higher the sale price of older boxes when leases expire.

Down — but still higher than in any previous year except 2021.

“When we look at the market, we say, boy, this is actually a pretty nice market,” said Brian Sondey, CEO of Triton. “If you had transported us from 2015 to here, this would be unbelievable. But compared to unprecedented shortages and unprecedented pricing last year, it’s down a little bit.”

Sondey described last year as “an extreme container shortage” and the current market as “still pretty tight” but “not quite as extraordinary as 2021” and “more of a regular market.”

New container equipment market

Liner companies “have been more cautious about growing their container [equipment] fleets this year,” said Sondey. Leasing companies are also ordering fewer boxes. “When prices are changing, leasing companies can be a little bit more cautious” in their own ordering, said Sondey.

Chart: Triton Q1 2022 presentation. Prices in $ per TEU

Chart: Triton Q1 2022 presentation. Prices in $ per TEU

That’s a 25% drop from the peak, albeit still higher than pre-COVID prices. Sondey described July 2021 container pricing highs as “a condition we’ve never seen before,” noting that “the market just can’t stay at that level forever.”

For liners that lease new containers from companies like Triton, as opposed to ordering them on their own account, lease rates are likewise down from 2021 highs. “Container prices are now reflected in leasing rates as well,” confirmed Sondey.

Liners took boxes on lease from Triton for average durations of 12-13 years in 2021. Duration has pulled back to 10 years in 2022. “I think that just reflects container prices coming back down to Earth a little bit,” said Sondey. “When container prices … are no longer close to $4,000, it’s easier to spread the premium [over fewer years].”

Secondhand container equipment market

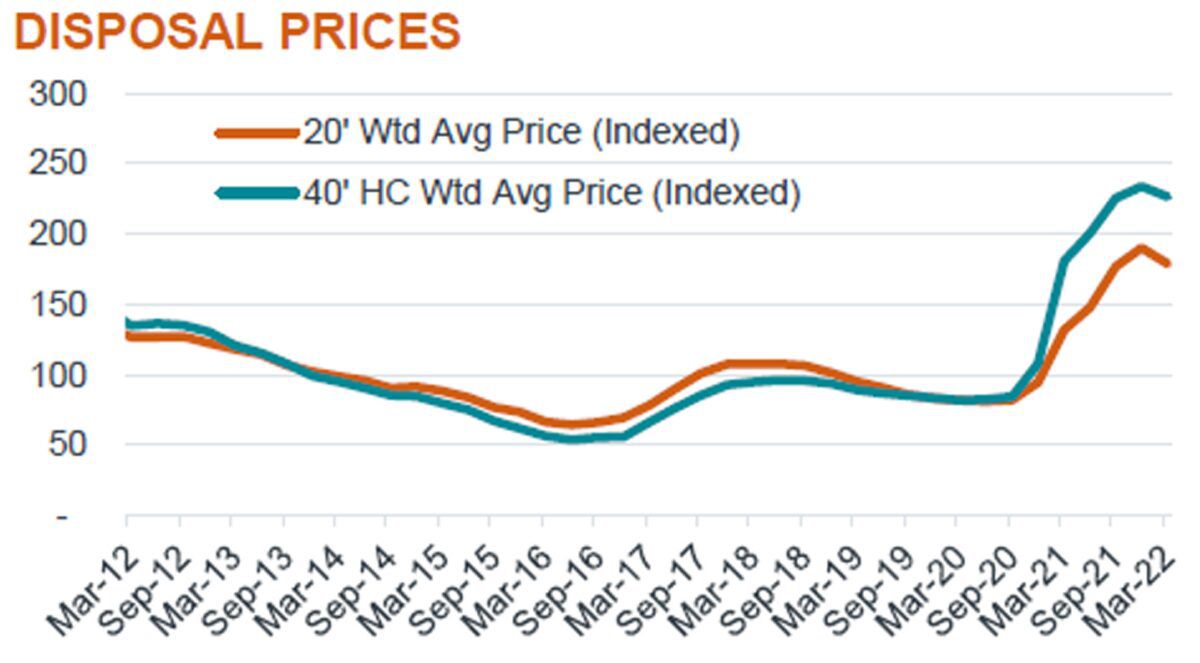

Another key indicator is the resale price of old containers that come off leases and are disposed of in the secondary market (for use as storage, etc.).

Chart: Triton Q1 2022 presentation. Index of weighted average sale prices of used containers

Chart: Triton Q1 2022 presentation. Index of weighted average sale prices of used containers

Disposal prices reached historic highs last year as liners deployed every old box they could find and the number available for resale plunged.

According to Sondey, “We’ve been saying for three or four quarters that our gain on sales and disposal prices have to come down [because] they were so extraordinarily high.

“And we are seeing prices starting to come down. We expect that to happen more … although we’re not trying to give the impression that we’re going to toggle back to where sales gains were in 2019.”

Supply chain crunch not be over yet

The signals from the container equipment sector confirm an easing in liner demand compared to last year’s extremes. However, Triton executives maintained that the congestion story is far from over.

“We’re hearing from [liner] customers that the bottlenecks that were really plaguing the shipping industry — and, I think, the economy — are still there,” said Sondey.

According to O’Callaghan, “Disruptions have been exacerbated by what has been happening in the major port areas in China. There is potential for further disruption on the West Coast as congestion ping-pongs back and forth between Asia and the U.S.”

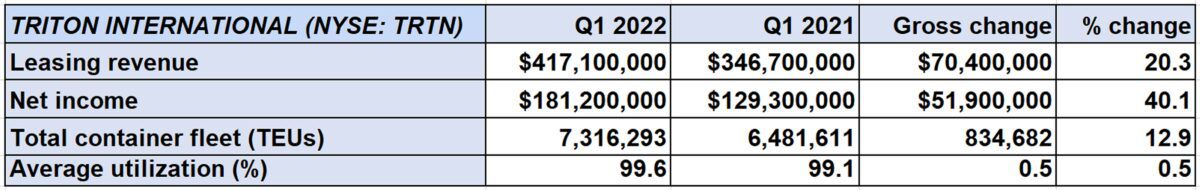

Triton earnings

Stocks in the various segments of ocean container shipping have been pulling back since late March and early April despite expectations for record first-quarter earnings and continued strong earnings through the rest of the year.

Triton is a case in point: It posted record net income of $181.2 million for Q1 2022, versus net income of $129.3 million in Q1 2021. Adjusted earnings per share of $2.78 topped the analyst consensus of $2.63. As of Tuesday’s close, Triton’s stock price was down 12% from its 52-week high on March 23, despite rising 5% on the day of the earnings beat.

Triton expects to earn less in Q2 2022 than in Q2 2021 due to lower pricing for old containers sold in the secondary market.

In terms of share price, Triton faces the same headwind as much of the public container space: Earnings remain extraordinarily high by historical standards and an unprecedented amount of revenue has been locked in, but stocks are down from their highs because container prices and rates have come off last year’s historic peak.

“We keep trying to say we think it’s not a question of the trajectory of the earnings. It’s where they are, and how they relate to the value of the business,” said Sondey.