Europe’s policy shift to LNG and away from Russian pipeline gas has sent cargo import volumes surging by 65% in the first nine months of 2022 versus the same period in 2021.

Unsurprisingly, LNG imports to Europe from almost every supply source will increase, while a significant volume that was previously going to other markets, such as Asia or Latin America, is now being consumed by Europeans.

This isn’t how things were supposed to be.

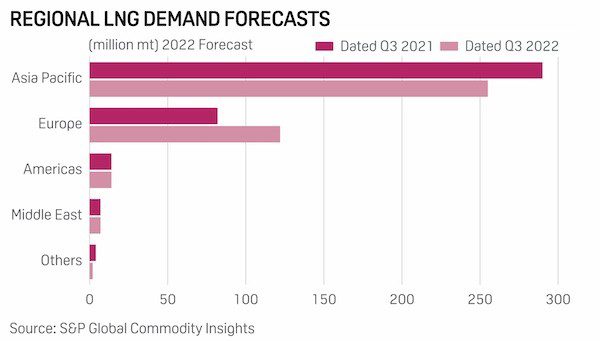

Analysts at S&P Global Commodity Insights forecast as early as one year ago that Asia Pacific, the world’s largest LNG consuming region, will post a 5%-10% LNG demand growth in 2022. Demand is now likely to fall by that percentage range this year.

China, which has been the growth engine for LNG demand until 2022, is on course to import the lowest amount of LNG since 2019. Several companies in China are in the process of a major regasification capacity buildout over the next two years – upward of 50 million mt by end-2024 – but with international spot prices still higher than downstream prices in much of the country, the prospects for near-term growth are weak.

Meanwhile, Europe’s policymakers had been creating an environment where managed decline of LNG imports was likely. Forecasts reflected this: a Q3 2021 outlook from S&P Global suggested European LNG demand would reach 82 million mt in 2022, or flat on-year, and fall until the middle of the decade.

European LNG demand forecast vs reality

In fact, Europe (including UK and Turkey) imported nearly 95 million mt in Q1-Q3 2022. This amounted to 32% of global LNG imports, versus just 21% in 2021. Of the total spot trades – which has dropped to under 29.5% of total LNG trade in 2022 compared to 33% in 2021 – Europe takes credit for one-third. In 2021, Europe accounted for just 12.6% of total spot activity, below Latin America.

The reasons for these rapid, tumultuous changes in flows are well-known. The purpose of this report is to highlight where this influx of LNG is coming from, why it is coming from there and how prices are changing to determine arbitrage.

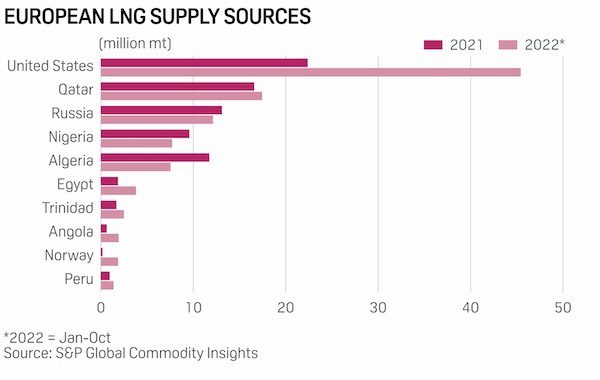

European LNG supply sources

Europe’s top three LNG suppliers remain unchanged: the US, Qatar, and Russia. However, within this list there are hidden details.

US exports to Europe have already more than doubled on-year even before Q4 started. This highlights the flexibility of US-origin LNG: it goes to where the highest price is. On average, European LNG prices have been higher than Asian LNG prices when considering the freight difference from US-Europe and US-North Asia.

Qatar’s exports have risen more modestly, and the gains are mainly into markets where the exporter has long-term terminal capacity: UK, Belgium and Italy. Those three countries account for nearly 80% of Qatar’s Europe-bound exports, up from two-thirds in 2021. Long-term terminal access capacity has been crucial this year, when the price difference between gas hubs and LNG delivered-ex-ship prices have been at their widest on record. Having long-term capacity allows companies to take advantage of this greater margin.

These are the two reasons for the surge in LNG imports to Europe: for those with access to long-term terminal capacity in certain locations they have been able to take advantage of the new premiums for European gas hubs; for those without but with access to US-origin volumes, they have generally been receiving stronger prices on a DES Europe basis than a DES Asia basis for cargoes.

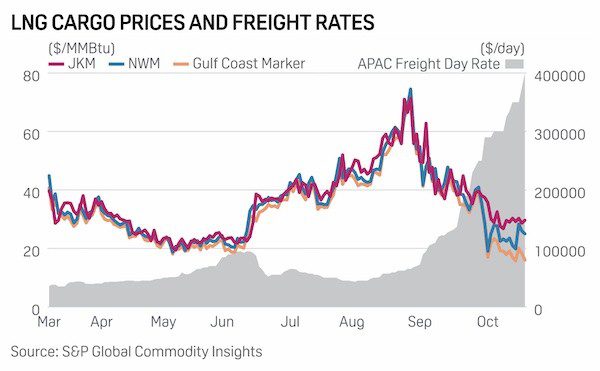

The discount to European gas hub prices for European LNG has been the subject of much debate in 2022. Some market commentators have reasoned it away as purely the cost of terminal access. In fact, there are three factors that determine the difference in European LNG against European hub prices: global LNG market dynamics (the relative pull or push of material from other regions), inter-European hub price differences, and the cost of secondary terminal access.

LNG prices and freight rates

Were terminal access costs the only determinant of the differential, European LNG prices would never have been at a premium to European hub prices as they were for the majority of 2021, when strong demand from China and Brazil dragged spot tons away from Europe. LNG being at a premium to European hub prices was a factor in the lack of stock build seen in Europe in 2021, which precipitated some of the present crisis.

Europe’s third-largest LNG supplier, Russia, has also seen a tightening in the concentration of its offtake markets in Europe, but for very different reasons. Spain, France and Belgium – three markets for a variety of reasons that are the most likely to take term Russia-origin LNG – have seen volumes increase over 3.3 million mt in Q1 to Q3 on-year. Globally, while Russia is likely to export more LNG in 2022, its largest buyers are taking up a larger proportion of its total exports.

In conclusion, Europe’s shift to LNG has had profound effects on global trade flows, and in the spot market has moved volumes from major growth areas such as China. This dynamic is likely to persist in 2023 as Europe remains reliant on near-term LNG imports and there is very little prospect of Russian pipeline flows matching even the volumes seen in 2022.