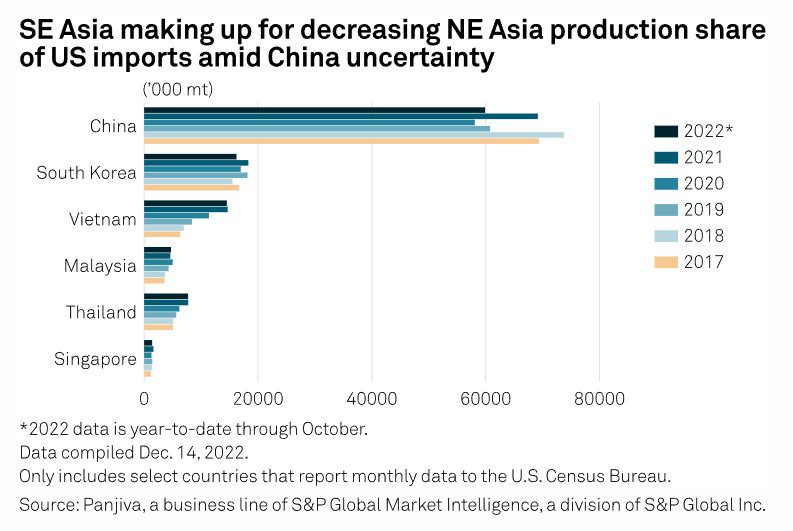

North American importers are reevaluating their dependence on Chinese goods after the pandemic revealed the value of a diversified supply chain. Political instability, high tariffs and lockdowns due to the country’s “zero-COVID” policy have driven many shippers to shift some manufacturing to Vietnam, Thailand and India, among other South and Southeast Asian countries, where infrastructure capabilities still pose a key hurdle. Nonetheless, a move away from Chinese manufacturing is driving carriers to reposition assets in 2023.

Apple, Samsung and Hasbro are just a few North American importers who have reshuffled manufacturing from China into countries where labor costs remain low, but tariffs and lockdowns aren’t dictating profitability.

In fact, the active discussion around supply chain reshoring increased significantly during the pandemic, with mentions of reshoring and nearshoring in S&P 500 transcripts reaching an all-time high in 2020.

Gartner, Inc. surveyed 260 global supply chain leaders in February and March 2020 and found that 33% of respondents had already moved some of their manufacturing out of China or planned to do so in the next three years. Much of this shift can be attributed to tariffs on ex-China goods, as well as pandemic-related production interruptions.

“Current tariffs being what they are for China-made products is shifting where [North America] imports from,” a freight forwarder said. “Government intervention, city shutdowns, things like that — t’s shifting demand.”

Kamala Raman, senior director analyst with the Gartner Supply Chain Practice, said the tariffs on ex-China cargo imposed since 2019 increased supply chain costs by up to 10% for more than 40% of study participants. For more than a quarter of respondents, the impact was even higher.

In terms of cost of freight, imports from Southeast Asia are comparable to those from North Asia. Platts Container Rate 5 — North Asia-to-East Coast North America — was assessed at $2,/FEU on Dec. 20, at parity with Southeast Asia-USEC rates. For USWC imports, rates from North Asia held a premium of $50 over Southeast Asian loadings.

As more carriers continue to see weak rates for Chinese exports, increasing demand on Southeast Asia-to-North America trade routes will likely influence rates for the trade lane in 2023.

An unfeasible shift

While tariffs may pose a hurdle, moving a supply chain is even more difficult, said Cameron Johnson, a professor at New York University in Shanghai specializing in supply chains. The process can take decades and other countries don’t have the infrastructure to compete with China’s exporting capabilities, he said.

“If you took 10% of the containers that currently go from China to the US, [into] Southeast Asia, you’d have to upgrade the infrastructure [significantly],” Johnson told S&P Global Commodity Insights.

Five traits are needed for a country to be an effective supply chain, Cameron said: advanced infrastructure, a skilled labor force, raw materials, technology and government support, according to Johnson. While a country may have an inexpensive labor force, other variables — like government instability or a lack of port infrastructure — will eventually drive importers back to China.

The diversification taking place is less about “moving” the supply chain and more about “extending” it. Products may be assembled in India and Vietnam, but the components are still made in China. Additionally, Chinese financial regulations may require a company repay any financial support it received before relocating.

Fleeting trend or permanent change?

One carrier source said they have already repositioned about 5%-10% of their fleet from China to Southeast Asia. However, diversification may be trendy, and Johnson expects companies to continue to use China as their main source of manufacturing, comparing the interconnectedness of a supply chain to the root system of a tree.

“You can’t just take out a tree root system,” he said. “You can’t really rip it out without causing extreme damage.”

Yet the swing to other manufacturing countries could well provide for a stronger, more stable supply chain — and the shift will continue into 2023 and it would make sense that carriers are shifting away from China as well, sources said.

“Most [carriers] call Shanghai, Shenzhen and Ningbo on a daily basis,” a freight forwarder in Europe said. “It will be interesting to see how these lines shift away.”

Hapag Lloyd has seen a trend of manufacturers moving from China to other countries, including Vietnam, Thailand and India, and the re-allocation of assets has already begun, spokesperson Nils Haupt said.

“Accordingly, our network is incorporating these developments,” Haupt told S&P Global. “[We have] increased our services from and to India significantly.”