Japanese refiners look set to boost kerosene imports for winter in a rare move as domestic production and inventory are insufficient to meet the country’s demand after a series of refinery issues, market sources told S&P Global Commodity Insights.

The refiners’ move comes as local trading houses, usually key importers of the middle distillate, have significantly reduced their kerosene imports amid relatively high import costs, and that supports the refiners’ additional imports in the face of current cold spells and snowstorms in northern Japan.

Citing the trading houses’ significantly reduced kerosene imports as “a slight concern,” Petroleum Association of Japan President Shunichi Kito said Dec. 19 that refiners will absolutely make sure of stable kerosene supply in Japan by possibly boosting the product’s imports in the event of a need.

A recent decline in the medium range, or MR, tankers’ freight is also making it relatively less costly to buy kerosene cargoes from North Asia for delivery into Japan, a shipping broker in Tokyo said. Most requirements for loading in December are already covered, the broker said.

Importers are now looking to charter ships for loading kerosene early in January.

MR freight on the key South Korea-Japan route has fallen 23% in December as of Dec. 20, according to S&P Global Commodity Insights data, and some brokers say the downward trend is still intact with current freight costs less than $25/mt to move a 35,000-mt cargo on the route.

Kerosene cargoes, with volumes for each lot in the 45,000-55,000 barrels range for early January loading, changed hands at a premium of $4-$5/b to Mean of Platts Jet /Kerosene assessment, FOB Korea for Japan, sources said, adding that the premiums could vary depending on the cargo size and loading period.

Import outlook

Two market sources said that three oil refiners have purchased at least six kerosene or jet fuel cargoes on MR-sized vessels that would arrive in November or December.

The refiners’ kerosene imports came as domestic kerosene stocks had been hovering well below the low end of their historical range until end-November. The low inventory was due to planned and unplanned refinery shutdowns and prolonged maintenance due to worker shortages caused by COVID-19 that disrupted the refiners’ production plans since the beginning of 2022, a refiner source said.

Japanese refiners and trading houses mainly import kerosene from South Korea, but some refiners import kerosene produced in China through global commodities traders, another trader said.

“If China’s export quota is large [after January 2023], South Korean refiners may demand a lower premium [to the Mean of Platts Singapore Jet /Kerosene assessments] to Japanese companies, so we and refiners are paying close attention to newly revealed quotas,” the trader said.

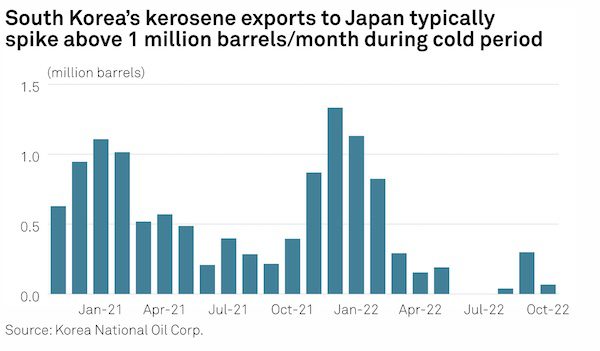

South Korea’s kerosene exports to Japan typically spike to about 1 million /month during the December-February cold period.

While it is possible for South Korean refiners to add 20% to 30% of monthly shipments to Japan over the next couple of months, strong heating fuel demand from European traders could mean that around 1.4 million /month would be the maximum volume that South Korea would be able to provide Japan in January and February, according to middle distillate marketers at two major South Korean refiners and analysts at Korea Petroleum Association.

South Korea exported 3.3 million barrels of kerosene to Japan over December 2021-February 2022, data from state-run Korea National Oil Corp. showed. Kerosene shipments to Japan averaged 375,000 /month in the first 10 months of 2022, KNOC data showed.

La Nina

According to the La Nina preliminary report from the Japan Meteorological Agency Dec. 9, there was an 80% chance that the current La Nina phenomenon will end in February 2023.

Winters in Japan during the La Nina phenomenon tend to be severe, and snowfall tends to increase in the Sea of Japan region.

In the face of cold spells and snowstorms hitting mainly northern regions of Hokuriku, Tohoku, and Hokkaido, kerosene demand has surged since mid-December, but supply remains stable.

“Our company expects kerosene sales in January to increase by 2%-3% year on year, based on forecasts of a colder winter than usual due to the effects of La Nina,” a refiner source said. “The demand and supply will be balanced in December, but it is highly likely that it will be tightened in January.”

Japan imported 5.53 million barrels of kerosene over December 2021-February 2022, down 46.4% year on year, data from the Ministry of Economy, Trade and Industry showed.