Due to significant business performance improvement of OCEAN NETWORK EXPRESS PTE. LTD. (hereinafter referred to as “ONE”), the company recorded 499.280 billion yen of equity in earnings of unconsolidated subsidiaries and affiliates for the consolidated cumulative second quarter. Within the recorded equity in earnings of unconsolidated subsidiaries and affiliates, “ONE” accounted for 494.552 billion yen in the cumulative second quarter, and 261.651 billion yen in the second quarter alone.

Performance per segment was as follows.

(i)Dry Bulk Segment

Dry Bulk Business

In the Cape-size sector, despite the increase in vessel supply caused by the stagnant economic activity and easing of port congestion in China, a main demand area, market rates stayed generally firm while fluctuating somewhat because of the subsequent recovery in demand for transportation and the increase of port congestion in the Far East due to heavy weather, which led to the tightening of the vessel supply-demand balance.

In the medium and small vessel sector, although the vessel supply increased due to the temporary decline in demand for transportation due to seasonal factors and the decline in demand for transportation of steel products to Europe, coupled with the easing of port congestion in China, market rates stayed generally firm, driven by the increase in demand for transportation of grains to China.

Under these circumstances, the Group strived to manage the market exposures appropriately and reduce operation costs and improve vessel operation efficiency.

As a result, the overall Dry Bulk Segment recorded a year-on-year increase both in revenue and profit.

(ii)Energy Resource Transport Segment

LNG Carrier, Electricity Business, Tanker Carrier and Offshore Business

Concerning LNG carriers, thermal coal carriers, large crude oil tankers (VLCCs), LPG carriers, drillship and FPSO (Floating Production, Storage and Offloading system), the business stayed firm for mid- and long-term charter contracts and contributed to secure stable profit.

As a result, the overall Energy Resource Transport Segment recorded a year-on-year increase both in revenue and profit.

(iii)Product Logistics Segment

Car Carrier Business

In the global car sales market, although supply shortage of semiconductors and auto parts, lockdown in Shanghai and the situations in Russia and Ukraine affected production and shipments in some areas, the recovery from the impact of COVID-19 continued. In addition, the Group strived to achieve the recovery of freight levels and improve operational efficiency.

Logistics Business

In the domestic logistics and port business, the domestic container handling volume maintained the same level on a year-on-year basis. In the towage business, the work volume stayed firm. The warehousing business remained firm. As for the international logistics business, although demand for ocean and air cargo transportation in the forwarding business showed a declining trend, handling volume generally stayed firm. In the finished vehicles transportation business, both land transportation volume and storage volume of finished vehicles increased.

Short Sea and Coastal Business

In the short sea business, although demand for transportation of steel and timber products stayed firm, the transportation volume of coal decreased year-on-year. In the coastal business, the cargo volume stayed firm and the truck transportation volume increased year-on-year. Transportation volume for passengers and passenger cars improved year-on-year due to the removal of restrictions on movements associated with COVID-19.

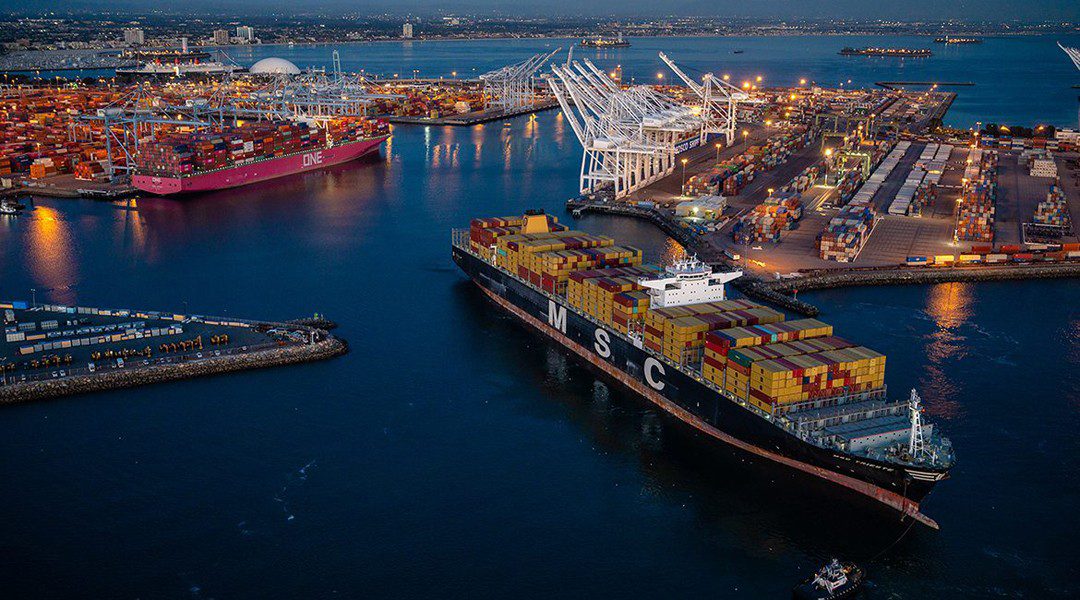

Containership Business

As for the performance of “ONE”, although the recent market rates weakened with the tight supply-demand balance easing, the overall market rates increased year-on-year. As a result, the business performance of “ONE” improved year-on-year.

As a result, the overall Product Logistics Segment recorded a year-on-year increase in both revenue and profit.

(iv)Other

Other includes but not limited to the Group’s ship management service, travel agency service, and real estate and administration service. The segment recorded a year-on-year increase in revenue and returned to profitability.

(2)Qualitative Information on the Consolidated Financial Situation

Consolidated assets at the end of the consolidated 2nd Quarter of this fiscal year were ¥2,175.675 billion, an increase of ¥600.715 billion from the end of the previous fiscal year as a result of an increase in investment securities and other factors.

Consolidated liabilities decreased by ¥29.126 billion to ¥560.950 billion as a result of a decrease in other current liabilities and other factors compared to the end of the previous fiscal year.

Consolidated net assets were ¥1,614.725 billion, an increase of ¥629.842 billion compared to the end of the previous fiscal year as a result of an increase in retained earnings and other factors.

(3)Qualitative Information on the Consolidated Prospects for FY2022

In the Dry Bulk Segment, despite the uncertainties, such as the effect of inflation in major countries on the global economy and the delay in the recovery of economic activity in China, market rates are expected to stay firm because the demand for transportation of coal associated with energy problems will support the market and limited building of new ships will lead to the tightening of the vessel supply-demand balance. With regards to these uncertainties, the Group will keep a close watch on the changes in demand for transportation and trade patterns, and prepare to respond quickly. At the same time, amid growing need to deal with environmental problems, take advantage of its strength in high quality transportation, the Group will strive to secure stable profit by increasing vessel operation efficiency and reducing costs as well as increasing mid- and long-term contracts.

In the Energy Resource Transport Segment, the Group will strive to secure stable profit under mid- and long-term contracts with respect to LNG carriers, thermal coal carriers, large crude oil tankers (VLCCs), LPG carriers, drillship and FPSO (Floating Production, Storage and Offloading system).

As for the Product Logistics Segment, regarding the car carrier business, although there are concerns over the impact of shortages of semiconductors and auto parts and the situation in Russia and Ukraine on global vehicles sales, sales and cargo movements are expected to recover and freight levels are expected to be restored. In addition, the Group will continue to strive to improve operational efficiency through such measures as appropriate fleet restructure and reorganization of the network of trades. Regarding the logistics business, demand for domestic container handling is expected to stay firm in the domestic logistics and port business segments. As for the international logistics business, demand for ocean and air transportation is expected to decrease in the forwarding business. In the business of transporting finished vehicles by land, the handling volume is expected to increase due to the continuation of the uptrend in vehicle imports in Australia. In the containership business, although there are signs of easing congestion at some ports, port congestion continues at major ports on the east coast of North America and in the Northern Europe, and supply chain disruptions are expected to continue. The global economy is becoming increasingly uncertain with the situation in Russia and Ukraine, global inflation, and rising interest rates, all of which may impact transportation demand. “ONE” will closely monitor the economic environment and strive for steady business operations while implementing measures to adapt to changes in supply and demand.

Our basic policy is to improve shareholder profits over the medium and long terms by proactively promoting shareholder returns, including share buyback. This is done by taking cash flow into consideration and ensuring the investment level and financial stability necessary to improve our corporate value. Based on this basic policy, regarding dividend for the fiscal year ending March 31, 2023, the Company resumes payment of an interim dividend of 300.00 yen per share (Before the stock split basis) and plans payment of a year-end dividend of 100.00 yen per share (After the stock split basis).

At the meeting of the Board of Directors held on November 4, 2022, the company resolved to repurchase its stock in accordance with Article 156 of the Companies Act of Japan, as applied pursuant to paragraph 3 of Article 165 of the Companies Act of Japan. Please refer to (Stock repurchase) on the page of (Significant Subsequent Event) for details.

Full Report