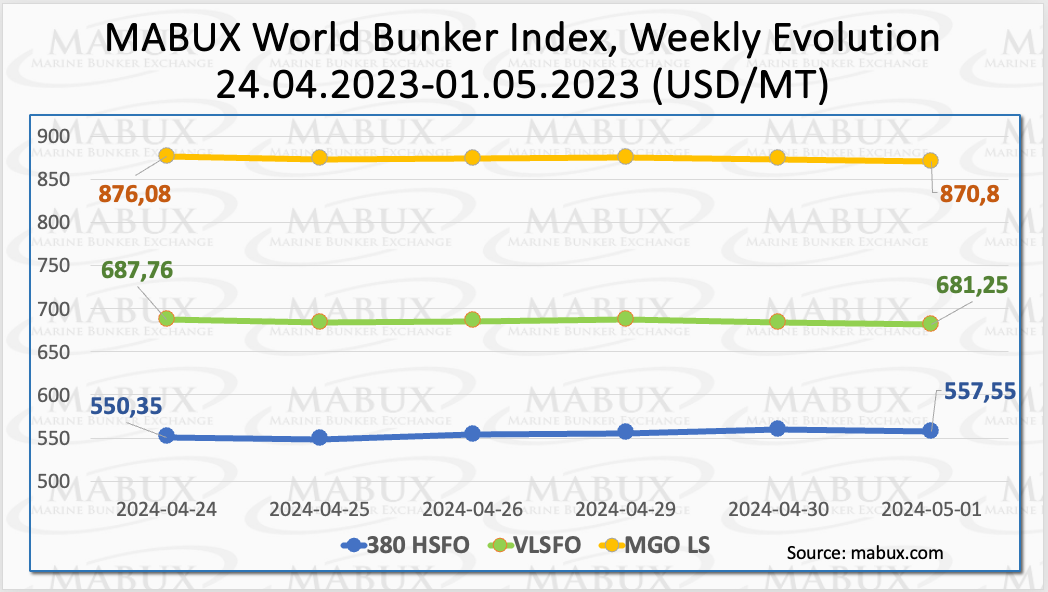

During the 18th week, the MABUX global bunker indices remained relatively stable, lacking a clear directional movement. The 380 HSFO index experienced a modest increase of US$7.20 to US$/MT compared to the previous week.

Conversely, the VLSFO index continued its downward trend, decreasing by US$6.51 to US$/MT. Similarly, the MGO index saw a decline of US$5.28 to US$/MT.

“At the time of writing, world bunker indices were in a moderate decline trend,” explained a MABUX spokesperson.

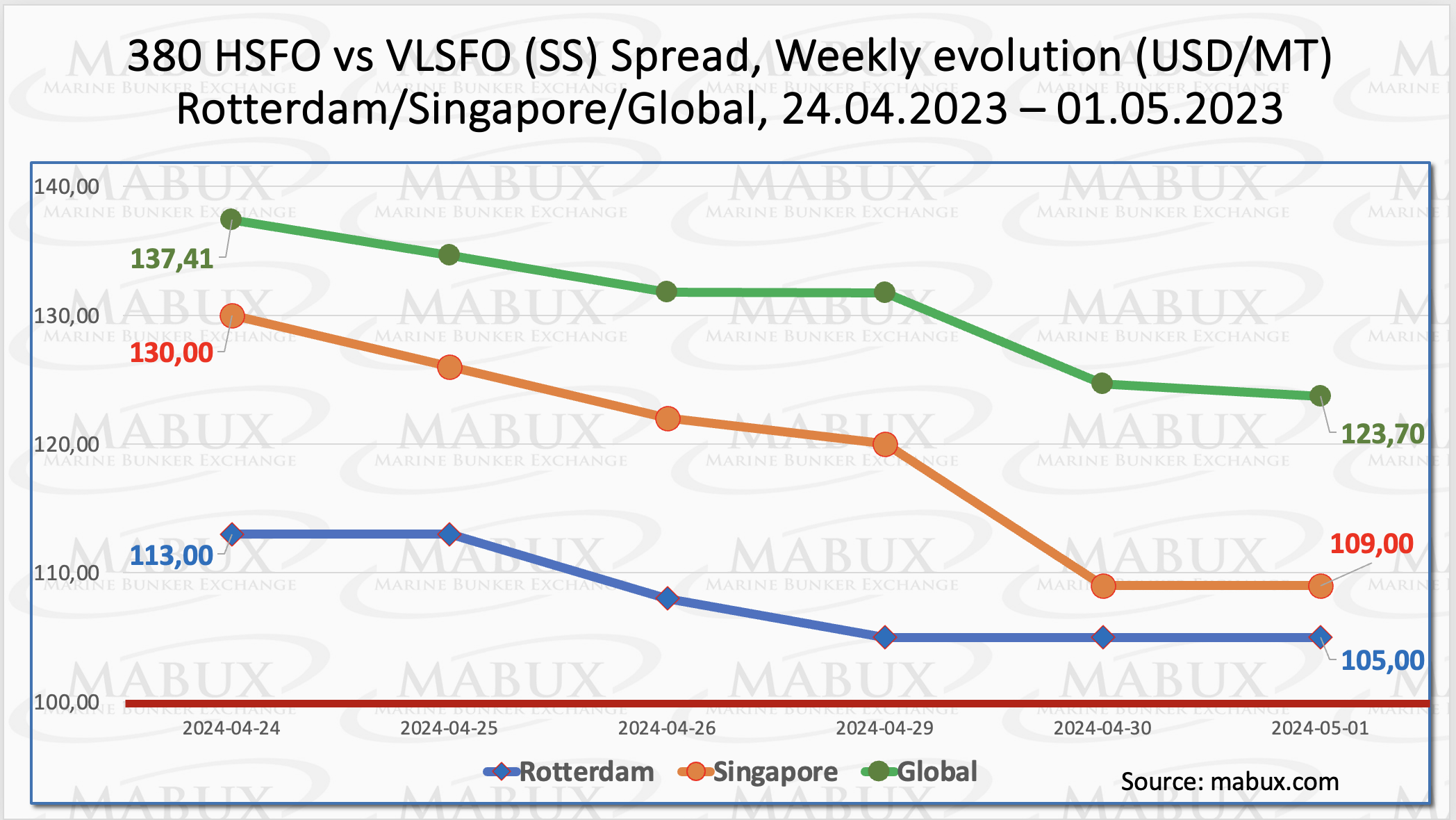

The MABUX Global Scrubber Spread (SS), representing the price variance between 380 HSFO and VLSFO, continued its decline, now standing at minus US$13.71. The weekly average also saw a decrease of US$7.99. In Rotterdam, the SS Spread diminished by US$8.00, approaching the US$100.00 threshold (SS Breakeven). The weekly average for the port also dropped by US$11.50. Singapore witnessed the most notable reduction in the 380 /VLSFO price gap, declining by US$21.00, with the weekly average decreasing by US$11.50.

“We expect next week the SS Spread dynamics to continue downward trend,” stated a MABUX official.

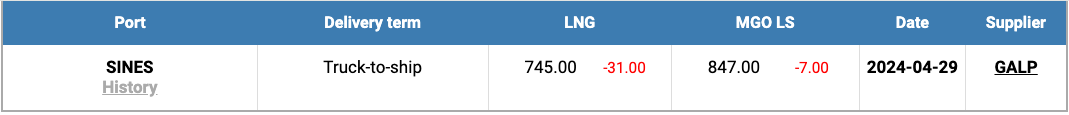

Natural gas prices have returned to their 10-year range, reflecting sustained high inventory levels and decreased demand. It’s expected that European LNG demand will reach its peak in 2024, primarily due to reductions in structural gas demand driven by the EU’s ambitious decarbonization goals. The ongoing development of 19 global liquefaction projects is set to increase LNG production by around 200 million tonnes by 2030, which is half of the current annual trade volume. Notably, approximately 75% of the LNG import capacity added in the EU since 2022 consists of Floating Storage and Regasification Units (FSRUs).

In the port of Sines (Portugal), the price of LNG as bunker fuel decreased to US$/MT on 29 April, marking a US$31 drop compared to the previous week. However, during the same period, the price difference between LNG and traditional fuel has widened, with LNG being favoured by US$102 on 29 April, compared to US$77 the previous week. On that day, MGO LS was priced at US$/MT in the port of Sines.

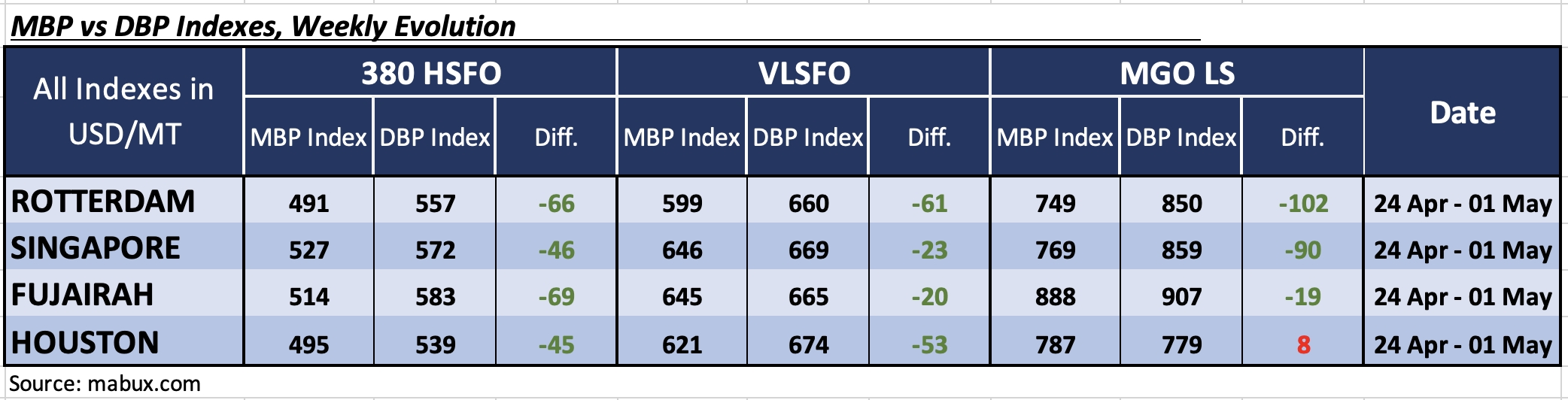

During Week 18, the MDI index, which compares market bunker prices (MABUX MBP Index) to the MABUX digital bunker benchmark (MABUX DBP Index), revealed the following trends across major world hubs: Rotterdam, Singapore, Fujairah, and Houston.

In the 380 HSFO segment, all selected ports continued to be undervalued. Weekly averages declined by 3 points in Rotterdam, 7 points in Singapore, 8 points in Fujairah, and 10 points in Houston. The levels of fuel underestimation across all ports are gradually decreasing.

In the VLSFO segment, as per the MDI, all ports were undercharged, with average weekly levels increasing by 8 points in Rotterdam, 5 points in Singapore, 7 points in Fujairah, and 8 points in Houston.

Regarding the MGO LS segment, Houston remained the sole overvalued port, with the average weekly overprice level decreasing by 4 points. All other ports were undervalued. Weekly averages increased by 4 points in Rotterdam but decreased by 8 points in Fujairah. The MDI index remained unchanged in Singapore, while in Rotterdam, it surpassed the US$100 mark again.

By the week’s end, the balance between overvalued and undervalued ports across all market segments stayed consistent. Although there’s a persistent pattern of bunker fuel underpricing, the levels of underpricing in the 380 HSFO and MGO LS segments are progressively diminishing.

“We expect next week the world bunker indices to continue irregular changes with no a

firm trend,” stated Sergey Ivanov, director of MABUX.