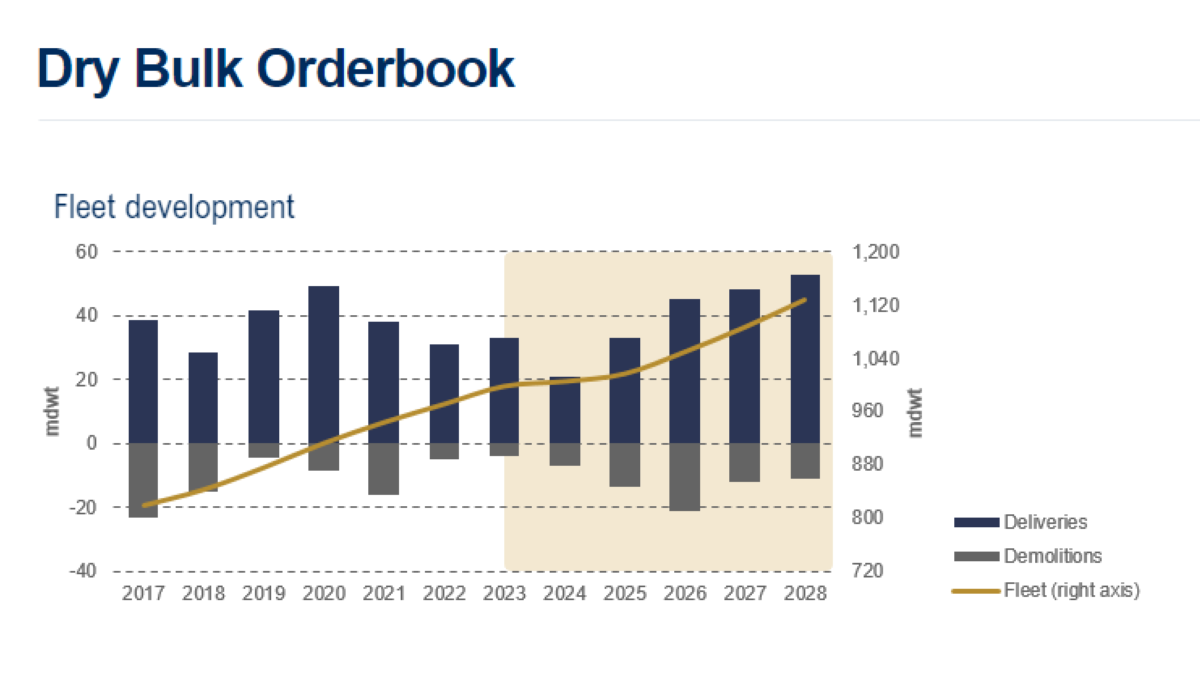

Dry bulk fleet development 2017 to 2028 (source: Drewrys)

Dry bulk fleet development 2017 to 2028 (source: Drewrys)

In Navigating the dry bulk market: challenges, opportunities and future outlook webinar, the panel of experts considered the influence of demand and supply, the market challenges and highlighted potential growth opportunities

Through insightful deliberations, BIMCO chief shipping analyst Niels Rasmussen, Lloyd’s Register global bulk carriers segment director Nikos Kakalis, and Drewry Shipping Consultants (Drewrys) lead research analyst – dry bulk Rahul Sharan navigated the complex terrain of the dry bulk market challenges while unveiling the promising growth opportunities that lie ahead.

The Navigating the dry bulk market: challenges, opportunities and future outlook webinar took place 28 June 2023, and commenced with a presentation on the dry bulk supply and demand situation given by Mr Sharan.

He said, “We (Drewrys) believe fleet growth will be very low in 2024 and 2025, mostly because of the orderbook to fleet ratio.” The ratio of orderbook to fleet has been around 5% to 7% for the last three years, compared with the levels of 60% to 70% a decade ago.

On bunker prices, Drewrys forecasts bunker prices will stabilise, and not taking into account any geopolitical tensions, should remain stable for the next five years.

It was a different outlook for newer fuels, “In the longer term, the prices of green ammonia should sharply come down,” he said. “In the short term, we project the natural gas price to move up for the next five years.”

Mr Sharan noted CII is having a significant impact on the dry bulk fleet, “In 2023, 46% of dry bulk vessels will fall into the D and E category,” he said. This will rise to more than 60% of dry bulk vessels by 2026.

This is likely to induce an increase in demolition, which coupled with the low orderbook, may lead to an increase in rates in the dry bulk sector in 2024 and 2025, noted Mr Sharan, wrapping up the supply-side analysis.

On the demand side, Mr Rasmussen of BIMCO noted the key to major commodity demand is China and its impact on tonne-mile demand. So far in 2023, tonne-mile demand from China has increased by 2.9% year-on-year, producing an actual volume increase in demand of 4.6%.

Overall, BIMCO is expecting the year to end with a growth of 2.3% and then another 1.7% growth next year, but as Mr Rasmussen pointed out, many of the agricultural commodities are weather dependent.

Mr Rasmussen noted there are signs that growth is returning to China, with Q1 2023 GDP growth of 4.5% versus the Chinese government target of 5% and the OECD’s leading indicator for China returning toward parity.

Returning to the supply side, Mr Kakalis of Lloyd’s Register noted that despite the low freight rates, demand for secondhand tonnage has been firm. He posited Chinese demand growth played a part, as did the low orderbook level.

Looking ahead, Mr Kakalis said, “We expect the market will be quite cautious: the expectation is the (newbuilding) market will start seeing much more activity from 2025 onwards.”

He also voiced concern with CII and regulatory developments beyond 2026, which Mr Sharan said would see 60% of the dry bulk carrier fleet fall into the D and E CII categories. What will owners do in 2026, he asked: upgrade vessels, scrap vessels or wait-and-see what the changes will bring?

The EU’s FuelEU framework will also have an impact, but also a commercial opportunity, noted Mr Kakalis. “This regulation allows emissions cooling,” he said, “The summing up of the penalties or benefits in terms of a total fleet evaluation.”

He added, “We have been doing calculations at the request from different owners.” In theory, an owner with a fleet of 20 dry bulk carriers could add a newbuilding operating on green methanol and pool the benefit of the lower emissions. This would produce a significant penalty saving which could be shared.

Takeaways

Rahul Sharan (Drewry Shipping Consultants): “There will be impact from the regulations, particularly the CII on the total supply of the vessels, and that will have impact on the freight rates and charter rates in 2024 and 2025.”

Niels Rasmussen (BIMCO): “On the demand side, it is uncertain what will happen. It looks fairly positive for this year, and next year that demand will grow faster than supply,” he said. “That assumes growth returns in China, and it comes on stronger in the second half of the year than it did in the first half of the year. It will not take much to change the market from a positive where demand grows faster than supply to demand growing slightly slower than supply – it is hanging in the balance.”

Nikos Kakalis (Lloyd’s Register): Returning to the FuelEU regulatory framework, Mr Kakalis noted, “Pooling emissions means there is an opportunity for a shipping company to consider or to find ways to have a more competitive fleet in the market.”

Webinar poll results

What will be the most popular fuel choice in 2050?

VLSO or HSFO with scrubber: 33%

LNG: 20%

/ammonia: 47%

When do you think dry bulk vessel demolitions will peak?

2024: 0%

2025: 7%

2026: 0%

After 2026: 93%

Do you think the CII ratings will result in higher demolitions?

Yes: 82%

No: 18%

If you were to place a newbuilding order today, what would be your primary fuel of choice?

VLSO or HSFO with scrubber: 25%

LNG: 38%

Methanol: 31%

Ammonia: 6%

We will place a newbuilding order…

In the next 6 months: 13%

6-12 months from today: 0%

12-24 months from today: 25%

Not for the following two years: 62%

The real estate sector has been a drag on the Chinese economy and on demand for iron ore imports. Will the real estate sector return to growth during 2023?

Yes: 0%

No: 100%

Year-to-date, coal has contributed to 75% of volume growth into China. Will the boom in coal imports continue despite increased domestic supply and record high coal stocks?

Yes: 60%

No: 40%

The current extension of the Ukraine grain deal will expire by mid-July. Will it be extended?

Yes: 55%

No: 45%

Source: Riviera Maritime Media

Niels Rasmussen (BIMCO), Nikos Kakalis (Lloyd’s Register), and Rahul Sharan (Drewry Shipping Consultants)