OSLO

It is actually a classic shipping story. Way too many ships to do way too little work. Or maybe not, because the crisis in the offshore industry has hit much harder and faster than anyone could have predicted. Especially the offshore carriers which work for the oil and rig companies on the Norwegian Continental Shelf are tightening their belts quite a bit.

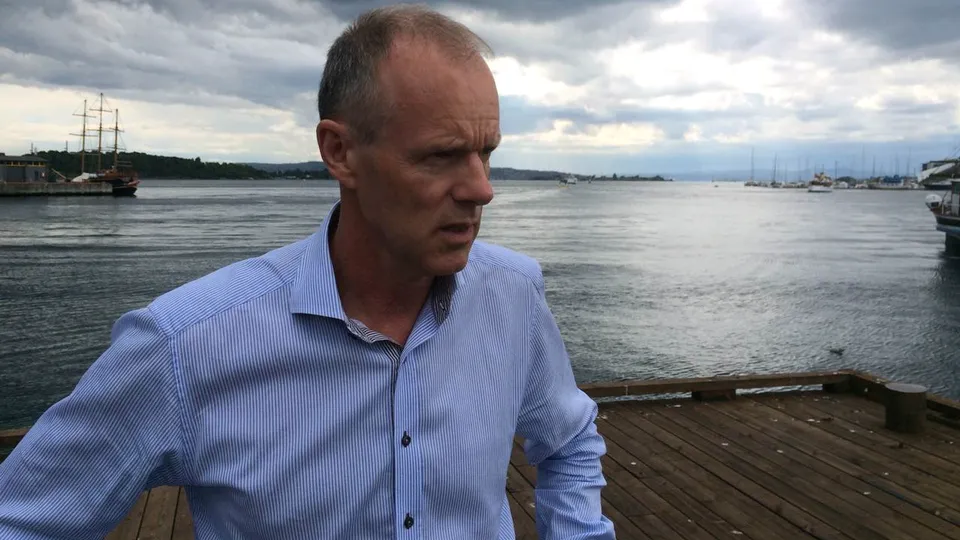

There are indicators that it will only get worse in time to come, and at the Norwegian Shipowners’ Association, CEO Sturla Henriksen does not try to hide the organization’s concern for a large portion of its members.

Try a free 40-day trial subscription to WPO

“On the offshore side it will go from bad to worse next year,” he says to WPO.

Last winter, the shipowners’ association compiled a comprehensive survey among its members in offshore which is about 50 percent. In this survey, the members expected that about 50 offshore supply vessels would be taken out of the market in the whole year 2015. By the end of June, 50 ships were anchored up off of the Norwegian coast and this is definitely an illustration of the hold which the crisis has on the industry, which in six months has developed much more darkly than first anticipated.

“You can expect that some ships will be scrapped. It’s not unlikely that several companies will have financial problems which will include restructuring, mergers and acquisitions or bankruptcies. We see that oil companies and there activities are the drivers in this,” says Sturla Henriksen.

Complete slowdown

Oil companies across the globe are slashing their activities. The Norwegian companies have the world’s second-largest offshore fleet and are therefore extra exposed to this developments.

Our companies can’t do anything about the markets, but they are doing what they can right now in terms of their own costs. Their idling ships and reducing crews. We’re seeing voluntary reductions in wages and work hours from the employees.

Sturla Henriksen, CEO, Norwegian Shipowners’ Association

Norwegian carriers have significant market shares on three shelves in particular, namely the Norwegian shelf, which has experiences massive growth in recent years, but which going through a large-scale slowdown. And it applies to the Russian part of the Barents Sea, where the sanctions against Russia, according to Sturla Henriksen, have left the market barren, while the comprehensive corruption scandal involving Petrobras pulled the rug out from underneath activities on the Brazilian shelf.

According to brokers Clarksons Platou, supply carriers in the first half of the year have reacted quicker to this development than expected, though it is going to take much more still in order to create a balance in the market. Even though the contracting rate for new vessels has slowed down, overcapacity with the current orderbook, if everything is delivered, will reach 500-600 vessels or 15-20 percent, chief analyst Erik Tønne recently told WPO.

More than 800 Norwegian oil workers fired in 10 days

It looks likely that somewhere between 100 to 250 of these vessel will be canceled or postponed at the yards, and these conditions do impact the offshore industry across the board, explains Sturla Henriksen of the Norwegian Shipowners’ Association.

No one left untouched

“This involves everyone, from oil companies to the carriers and rigs. We’re seeing rigs being idled, and we’re seeing rigs being taken off contracts early. It’s also impacting the land-based industry maritime in this country. There’s a very clear reaction, with a steep reduction in new contracts, and many players are trying to postpone or get out of contracts when they can. As a result, the Norwegian shipyards’ orderbooks are shrinking,” he says, adding:

Try a free 40-day trial subscription to WPO

“Our companies can’t do anything about the markets, but they are doing what they can right now in terms of their own costs. Their idling ships and reducing crews. We’re seeing voluntary reductions in wages and work hours from the employees,” he says, pointing as an example to one company where employees have taken a 10 percent pay cut and gone down to a four-day workweek in effort to prevent layoffs.

John Fredriksen’s North Atlantic Drilling recently had to lay off 200 employees, as the company – against expectations – failed to land a contract for the major Johan Sverdrup project. The same applies to Maersk Drilling, which has also announced layoffs in Norway for upwards of 190 employees. Norwegian industry media Sysla reports that the Norwegian offshore sector has lost around 829 jobs in just ten days.

Almost 200 jobs to be cut at Maersk Drilling

Not everyone is hit by the pressure of the crisis. Sturla Henriksen points for instance to the subsea companies, whose work is located at the later stages of field developments, and which therefore have plenty of work to do right now. Things look completely different for the seismic vessels, which project areas for future oil and gas fields, and which are therefore the first to be hit.

“The companies working in subsea are still noting high activity, as they come in fairly late in the process and have contracts that are still in place. But they’re contracts run until the fall, after which everything dies down completely,” says Sturla Henriksen.

As such, the industry should prepare for an even tougher year in 2016, he says.

“2015 is difficult, but 2016 will even more challenging.”

Nordea: Hundreds of oil rigs will be retired

Clarksons Platou: Offshore carriers must idle ships on large scale

Statoil warns of new cost reductions

Norway now ready with new maritime strategy