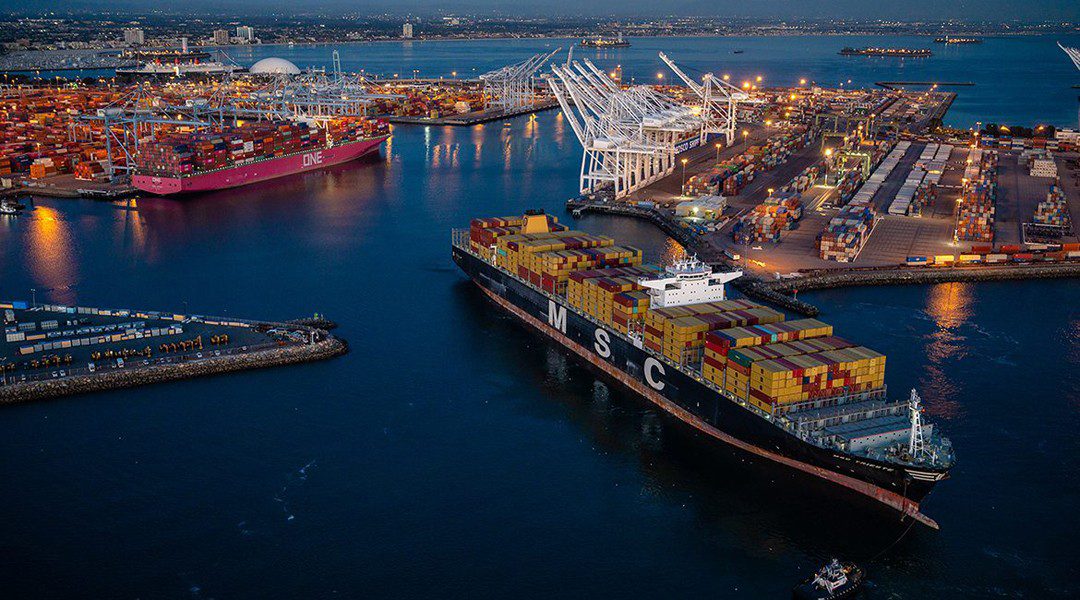

The twonew cranes towering over a huge cargo ship are tall enough to reach even the highest of the containers that are stacked up five on top of each other. Trucks are linedup on the newly built 400-meter (1,324-feet) quay of thedeep-water Port of Berbera, in Somaliland, waiting for the containers to be offloaded.

Mohamed Atteye has been a shift manager at the Berbera terminal since 2021, when the facility reopened after two years of refurbishment. The bearded man watchesas the cranes gently move.

Not too long ago, unloading such a huge container ship was a dangerous task, he said, because dock workers had to use the ships’ own cranes.

Atteye points out that turnover ofcargo and containersat the port has substantially increased with the new equipment. Fouryears ago, the teamwas only able to handle seven containers an hour. “Now we can do30 per hour. So you can see the big difference, the big jump,” he told DW.

Before its upgrade, Berbera Port could handle only about 150,000 standard 20-feet containers a year. Current capacity is about four times as many, and there are plans to expand that further to about 13 times the cargo handled in the past.

Free trade zone aimstoattractinvestments,jobs

Berbera Port’s expansion was financed by DP World, a multinational logistics company based in Dubai. Specializing in cargo logistics, port operations, maritime services and free trade zones, the company has commercial interests in 34 countries, among them 12 in Africa and the Middle East.

In exchange for its $442 million (€416 million) investment, DP World has won a 30-year concession with an automatic 10-year extension tomanagetheport.

Following the first phase of expansion, a second phase is currently under construction, which includes extending the new quay to 1,000 meters and adding another seven gantry cranes. In addition, the company has set up what it callstheBerbera Economic Zone —a free trade zone aimed at attracting investments and jobs in a range of industries.

Somaliland broke away from Somalia in 1991and has acted as a de facto independent state since then, although itis not internationally recognized. The deal with DP World could create fresh momentum for the breakaway region’s drive toward recognition.

‘Berbera is in avery strategic location’

From his office, Supachai Wattanaveerachai has a perfect view of the stacks of containers and the new quay. Previously in charge of DP World’s operations in East Africa and the Middle East, the Thailand-born manager is now chief executive officer of DP World for Berbera Port.

Wattanaveerachaibelieves the area around the Horn of Africa is becoming a growth region. Ethiopiaalone hasa population of more than 100 million people.

“Ethiopia is a landlocked country. They need to have multiple gateways to serve the country. And Berbera is in avery strategic location. If you look at the distance from Berbera up to Addis Ababa, it is 900 kilometers [559 miles] —the same as Djibouti,” Wattanaveerachai told DW.

Djibouti is a small independent state situatedat the Horn of Africa that shares it border withSomalia to the south, Ethiopia to the southwestand Eritrea to the north. About 90% of Ethiopia’s trade currently passes throughDjibouti’s port, said Wattanaveerachai.

The DP World manager is convinced Berbera Port can compete with its rivalsto the benefit of Somaliland and its people. “We are looking for profit, but a long-term, sustainable profit. So we need to make sure that the people around us have a better life, then they willsupportus,” he said.

Wattanaveerachai addedthat DP World’s investment has brought financial benefits worth $116 million to the local community over the past five to six years, including 2,700 jobs. Overall, the government budget willbenefit to the tune of $87 million in direct revenue annually.

Two-thirds of goods headed for Ethiopia

A few miles outside Berbera, Joseph Oguta shows off a site developed by DP World that is set to become the Berbera Economic Zone The Kenyan will head the free trade area that is due to open at the beginning of 2023.

The facilities which are available for annual rental, long-term leases of 25 years or sale include offices, prebuilt light industrial units as well as serviced land plots. Companies willing to settle there will beoffered a wide range of incentives, including exemption from corporate tax, duty-free storage of goods, exemption from import or export permitsand the ability to employ foreign labor.

“Whatever comes here, comes in tax free. On exit it depends on where it is going. If it is going for export, then of course, there will be no taxes on it. If it is going to the local market, then the importer will have to pay taxes,” saidOguta.

DP World estimates that two-thirds of the goods shipped via Berbera Port —mainly wheat, processed food, machines and construction materials —will be destined for Ethiopia. With a population of 4.2 million people, Somaliland is too small a market for the investment, the company has said.

Risky business amid complex politics

May Darwich, an associate professor in international relations of the Middle East at the University of Birmingham, said Somaliland’s goal to become a maritime gateway for its neighbors is full of risks. She has just returned from a visit to Djibouti and Berbera as part of her studies into infrastructure investments in the Horn of Africa.

“It is very, very high-risk. The Somaliland government earnsmuch of its income through customs, which will be lifted. So that isa large loss in revenue. In return, Somaliland will like to see some of the development, trade, investors coming in. So I think that is the hope,” she told DW.

The Berbera Port project got off to a rocky start, however. Initially, Ethiopia wanted to participateby buying a stake of 19% in the project. Butits war in the Tigray regionplunged the country into economic crisis. The COVID-19 pandemic added to Ethiopia’s woes asglobal trade stalled. As a result, Ethiopia opted out, leaving DP World andSomalilandas the only shareholders in the project, with stakes of 65% and 35% respectively.

Sign of stability in an Africanhot spot

The mastermind behind Somaliland’s port and trade zone projects is Saad Ali Shire, the breakaway region’s finance minister.

In an interviewwith DW, he said he isn’t worried about a drop in revenue in the wake of duty-free imports as part of the free trade arrangement with Ethiopia. The ownership structure would still guarantee enough income.

“Any profit that is made is divided by the ownershipratio. Any ship that comes to dock is charged separately by the Somaliland Ports Authority. And then, when the ship docks and the goods are unloaded, they are charged a handling fee, whether it is in transit or used domestically,” saidShire. “The more goods that come, the more money we earn.”

Darwich thinks the Somaliland government never really had a choice other than finding strong economic partners for its economic development. Giving DP World a majority stake in the project may not have been the best deal, but there wasn’t any better option.

“They thought: ‘Well, if we don’t give up those rights, we will not be able to develop the port otherwise.’ They are in the difficult situationwhere they don’t have the resources. In a way that is how the deal comes across,” she said.

Apart from the commercial aspects of the project, Somaliland’s trade ambitions could bring the breakaway region back into the political spotlight in the Horn of Africa. Asit seeks political recognitionas an independent state, thecranes in the Port of Berbera could become a sign of stability in a troubled region.