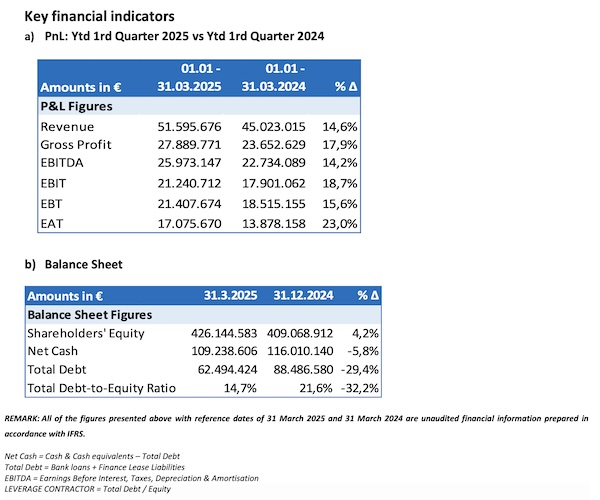

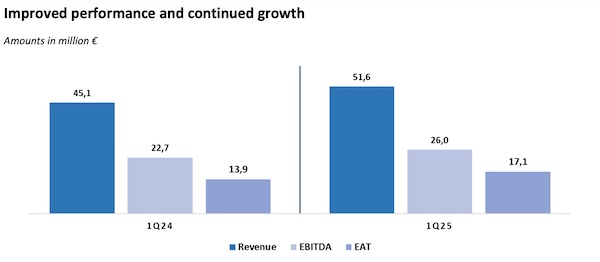

PPA SA announces financial results for the first quarter of 2025, focusing on the financial performance and strategic developments which configures its growth. The Company continues its upward trajectory of previous quarters, strengthening the Company’s steady growth despite the ongoing challenges which faces. The main points of the 1st quarter of 2025:

üSignificant improvement in revenues

üEffective management of expenses

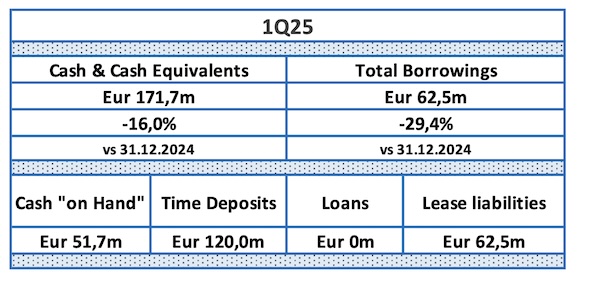

üImpressive improvement of its profitability indicators, while remaining its financial strength and strong liquidity despite the full repayment of (bank) loan obligations of € 26.5 million

1.Development by segment

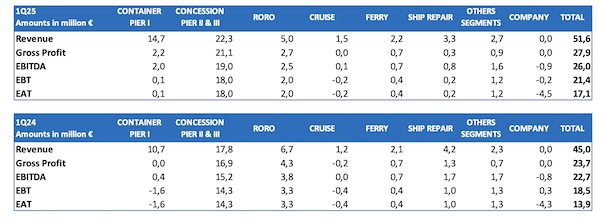

Revenues continued the upward trend of the previous period with all areas of activity controlled by the Company’s Management, contributing to this increase. Particularly notable were the Container Terminal (Pier 1), Cruise and Ferry Terminal sectors and the revenue of the concession from Piers II & III.

The improved results and profit margins reflect not only the improved revenue performance, but also the effective cost management policy implemented by the Company’s Management despite the ongoing challenges of the general inflationary economic environment.

Organic growth of the segments

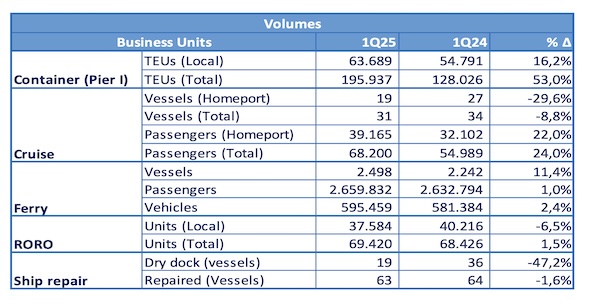

An increase in throughput compared to first quarter of 2024 was recorded in most of PPA’s operational sectors.

üThe increase at the Container Terminal is particularly positive, recording an increase of 53.0% in total cargo service. This upward trend is supported both by the performance of domestic cargo, which is increased by +16.2% compared to the corresponding first quarter of the previous year (from 54,791 to 63,689 TEUs) supported by the growth path of the Greek economy, as well as the impressive increase in transshipment cargoes compared to the corresponding first quarter of the previous year (+80.6% | from 73,235 to 132,248 TEUs).

üThe Cruise sector, having now established itself as a leading cruise port in the Mediterranean, continues its upward trend, both due to the increase in the number of homeport cruise passengers by +22.0% compared to the corresponding first quarter of the previous year (from 32,102 to 39,165 passengers), as well the number of cruise passengers who used the port of Piraeus as an intermediate station +26.9% compared to the corresponding period of last year (from 22,887 to 29,035 passengers).

üIncrease was also recorded by the Ferry sector, following the positive trend of the Greek market and Greek tourism.

üThe Car Terminal recorded a marginal increase in total loads by +1.5% compared to the corresponding period last year (from 68,426 to 69,420 vehicles), mainly due to the increase in transshipment vehicles by +12.9% (from 28,210 to 31,836 vehicles). Regarding the movement of domestic cargoes, it is emphasized that despite their overall downward trend, the movement of these cargoes recorded a significantly positive movement in March 2025 compared to March 2024 by +41.6% (from 11,758 to 16,645 vehicles). However, despite the increase in total vehicle movement levels in the first quarter of 2025 compared to the previous period, the total revenue of the sector decreased by € 1.9 million for the same period, which is mainly due to the resolution of most of the problems that had occurred in the sector’s supply chain, both domestically and internationally during the previous year, and results in the “normalization” of the length of stay time by cars at the port’s piers, which offered significantly increased storage service fees during the previous year (1Q25: € 1.5 million, 1Q24: € 3.4 million).

üConcession revenue collected by Piraeus Container Terminal S.A. for the operation of Piers II & III increased by approximately € 4.4 million (+24.8%) during the first quarter of the year compared to the corresponding period of last year, due to the increase in transit cargo.

Zero bank borrowing on 31st March 2025 (31.12.2024: € 26.5 million)

The company proceeded to a full and early repayment of its (bank) loan obligations of € 26.5 million on /2025, significantly reducing its exposure to interest rate risk, while maintaining its strong cash position. Its strong liquidity allows it to both invest in short-term term deposits and continue unintentionally the smooth implementation of its huge investment plan and overall operation. The significant generation of positive cash flow and the low debt-to- equity ratio indicate the ability contribute to the company’s strong financial position.

üThe Company’s financial income, which is mainly derived from its investments in short-term term deposits, appeared reduced by € 0.5 million compared to the corresponding last period (1Q25: € 0.8 million | 1Q24: € 1.3 million) mainly due to the decrease in deposit interest rates.

üThe Cash and cash equivalents clearly reflect its strong liquidity. It should be noted that the slight decrease in the cash balance and the Company’s Net Cash position during the current period is mainly due to the early repayment of its bank loan and the significantly increased cash outflows, compared to the same period last year for the Company’s fixed investments (see below).

üThe Company’s investment activity continues on the basis of its business plan and by the 1st quarter of 2025 total investments of € 16.1 million were made, compared to € 3,8 million in the corresponding period of the previous year (31.12.2024: € 59,5 million).

Source: PPA SA