According to Sea-Intelligence, the shipping companies lost $1.44 billion in combined EBIT in the fourth quarter of 2023.

Sea Intelligence noted EBIT loses for the following carriers: Maersk (-$920 million), Hapag-Lloyd (-$252 million), ONE (-$248 million), Yang Ming (-$109 million), ZIM (-$54 million), and Wan Hai (-$41 million) all reported EBIT losses in 2023-Q4.

Comparing over the same group of shipping lines (excluding ONE owing to a lack of historical reference points, and including Evergreen and HMM, both of which had operational profits in 2023-Q4), this was the greatest total Q4 EBIT loss in 2012-2023, with the previous high of -$455 million recorded in 2015-Q4.

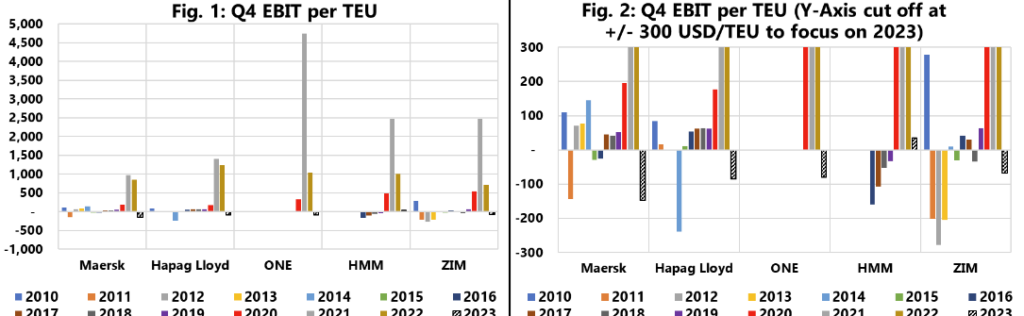

To examine profitability (or lack thereof) per TEU shipped, Figure 1 depicts the /TEU for 2010-2023 and the unprecedented levels of the 2021-2022 pandemic era, whereas Figure 2 cuts off the y-axis at +/- 300 /TEU to show 2023 trends.

© Sea-Intelligence

© Sea-Intelligence

READ: Evolution of vessel size on the Asia-Europe route

So far, we have /TEU data for five shipping lines, with COSCO absent from the list of companies that consistently report on both EBIT and worldwide volume.

Maersk’s /TEU of -148 /TEU is their highest negative /TEU during the study period.

Hapag-Lloyd’s /TEU loss of -84 /TEU is less than their previous negative /TEU loss of -239 /TEU in the fourth quarter of 2014.

For ONE, the negative 2023-Q4 /TEU of -80 /TEU is the first. HMM, on the other hand, reported a positive /TEU of 34 /TEU in 2023 Q4.

Recently, Sea-Intelligence reported that all shipping lines’ revenues fell sharply year-on-year (YoY) in 2023, ranging from 46.6 per cent to 62.6 per cent.